The stock market’s leaders are overvalued and could suffer a big correction, RBA’s Richard Bernstein said.

Losses could rival the dot-com crash, when popular stocks lost as much as 50% of their valule, he predicted.

But the event could be a great investment opportunity as gains are distributed to the rest of the market.

The most expensive stocks are poised for a steep correction, but that could present a “monster” buying opportunity in nearly every other area of the market, according to Wall Street veteran Richard Bernstein.

The RBA chief investment officer pointed to a discrepancy between the debt and equity markets, which could hint at a soon-to-come market correction. In the debt market, credit spreads are narrowing, which is what typically happens when corporate profits are growing. But, only a narrow group of stocks are dominating the equity market, which implies profits aren’t expanding for most companies.

There are a number of things that could explain that disconnect. The bond market could be flashing a false signal, which would imply that there could be a credit event and a wave of corporate bankruptcies on the horizon, Bernstein said.

However, the more likely explanation is that the most expensive stocks on the market are way overvalued and are headed for a correction, while the bond market signals rising strength for the rest of the companies that make up the S&P 500.

“Fundamentally, it makes zero sense. The bond market is saying corporate profits are going to be strong … but the equity market with this incredibly narrow leadership of seven companies is saying that it’s an apocalyptic earnings outlook,” he told Business Insider in an interview. “I think the stock market’s in a bubble and the bond market is right.”

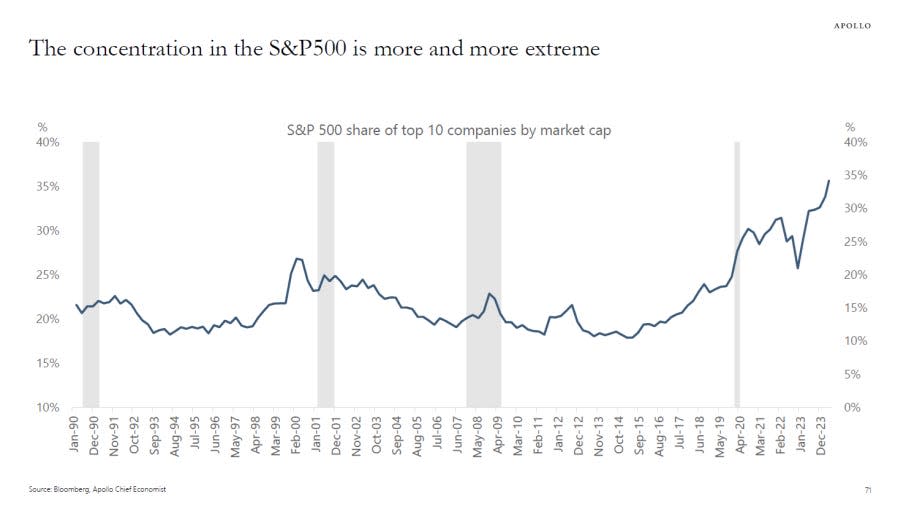

Stocks have flashed other warning signs that investors are too caught up in speculative fervor for a handful of name. The top 10 stocks in the S&P 500 make up 35% of the benchmark’s total value, the highest percentage ever recorded, according to analysis from Apollo.

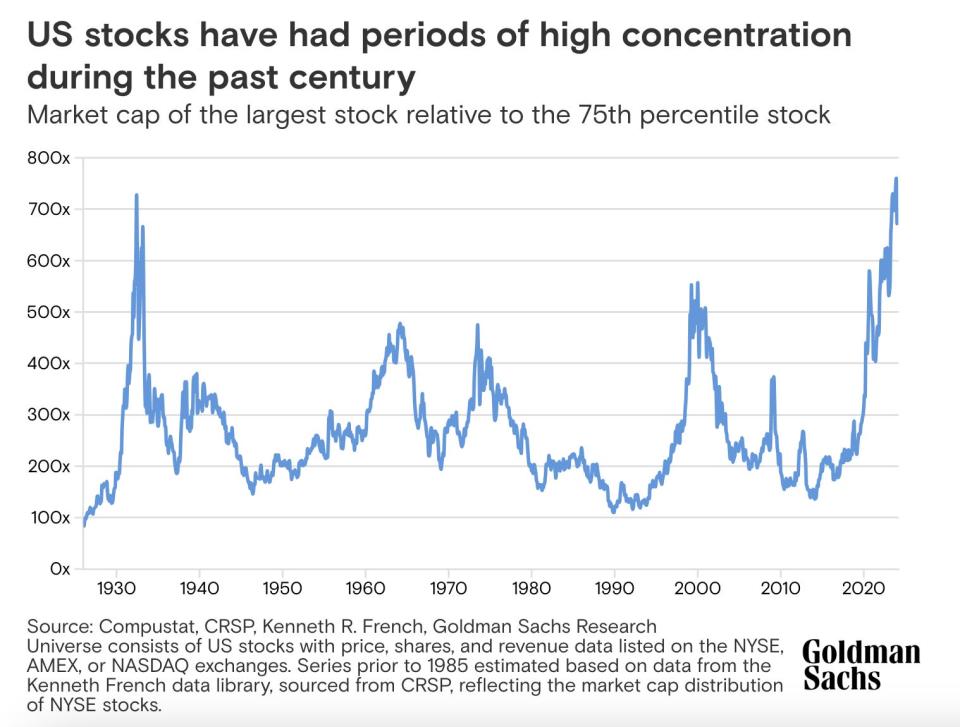

And when looking at the market cap of the largest stock on the market compared to the 75th percentile of stocks, the market looks to be the most overvalued since 1932, according to Goldman Sachs economists.

Bernstein didn’t have a prediction for when the bubble might burst, but it could inflict serious “damage” on the economy, with equity losses that rival the dot-com crash, he warned.

After the boom in internet stocks, the Nasdaq Composite dropped 78% from its peak, and tech stocks continued to struggle over the next 14 years. That paved the way for a “lost decade” in the stock market, with the S&P 500 losing 1% from 1999 to 2009.

“That’s what I think we’re looking at,” Bernstein warned. “It’s multiple years of significant underperformance.”

But for investors who have diversified away from the most expensive mega-cap tech stocks, the bubble popping would be good news for their portfolios.

While large-cap stocks tanked during the lost decade of the 2000s, small-cap, energy, and emerging market stocks did exceedingly well. The Russell 2000 gained 48% from 1999 to 2009 and the MSCI Emerging Markets IMI Index soared 145% in that time.

Bernstein says his firm is bullish on everything except the top stocks in the market today, which have soared amid Wall Street’s hype for AI. In a previous note, he said the stock market’s shifting leadership from the most-hyped names to underloved equities presents once-in-a-generation opportunity for investors.

“We like everything except for seven stocks. I actually think the opportunity set is probably the broadest it’s ever been in my entire career,” he said. “I think the opportunity is monstrous here.”

Read the original article on Business Insider

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel