Home buyers are frustrated by 7% mortgage rates. One economist suggests that they’ll need to get used to them.

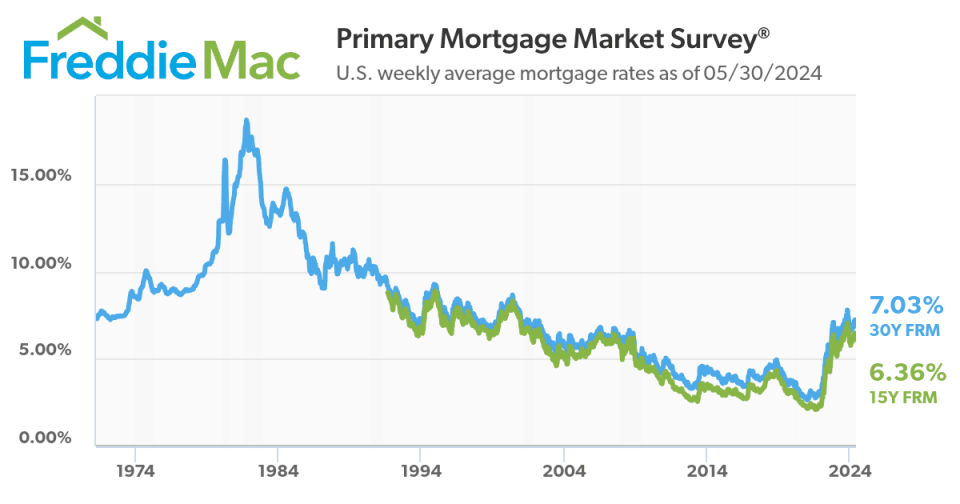

Since the Federal Reserve started hiking interest rates in mid-2022, mortgage rates have doubled, surpassing 7%.

Most Read from MarketWatch

Higher mortgage rates have resulted in significantly higher monthly mortgage payments and made buying a home harder to afford. At a rate of 7%, the median monthly mortgage payment for a $392,200 home is roughly $2,800, near a record high, according to a Redfin analysis. At a rate of 3%, that monthly payment would be close to $1,800.

Yet if one takes a longer view of the U.S. economy and mortgage-rate trends, the data clearly show that the 30-year rate is nowhere near its peak. In the 1980s, that rate went up to 18%, more than double where it was as of early June 2024.

In fact, based on historical averages, mortgage rates are closer to a “normal” rate now than they were during the pandemic, Doug Duncan, chief economist at Fannie Mae FNMA, told MarketWatch in an interview.

Between 1950 and 2000, the 30-year fixed-rate mortgage averaged roughly 6%, Duncan said. But during the pandemic — due to the Fed’s actions in easing monetary policy to support the U.S. economy amid widespread closures of businesses and other shutdowns — the 30-year mortgage rate fell as low as 2%. Many borrowers snapped that up.

So “a 6% mortgage rate is not unusual historically,” Duncan said. “It’s just that people saw these 3% mortgage rates and got spoiled. But that’s a historical anomaly. … Unless there’s some catastrophic economic event for the broader economy, we wouldn’t expect to see mortgage rates back at 3% in our lifetimes.”

Mortgage rates expected to drop to 6% early next year

On a longer-term basis, home buyers can expect some relief, as Duncan sees the 30-year mortgage rate falling below 6% over the next few years.

During that period between 1950 and 2000 when rates averaged 6%, inflation-adjusted economic growth averaged 3%, Duncan said. In comparison, with the Congressional Budget Office forecasting the U.S. economy to grow by between 2.1% and 2.2% per year through 2029, and factoring in the federal debt that would need to be funded through the issuance of U.S. Treasury bills, Duncan said he expects a more normal range for mortgage rates would be between 4.5% and 6%.

Home buyers can expect the 30-year rate dip to below 7% as early as the start of next year, according to Fannie Mae. In its May housing forecast, the government-sponsored mortgage-financing enterprise set expectations for the 30-year mortgage rate to fall to 7% by the fourth quarter of 2024. It also expects rates to drop below 7% in 2025, starting in the first quarter, and to finish the year at 6.6%. That forecast assumes that the Fed cuts interest rates twice by the end of 2024.

Lock-in effect is showing signs of fading

Fannie Mae also expects the growth in home prices to slow over the next few years. After a 6.6% rate of increase in 2023, home-price increases are expected to slow to a yearly gain of 4.3% in 2024 and 3.2% in 2025, Fannie Mae said, based on a survey of 100 experts as part of its quarterly Home Price Expectations Study.

And the so-called lock-in effect, which is holding up housing supply, is expected to fade. The lock-in effect refers to the number of home listings being abnormally suppressed as homeowners with ultralow mortgage rates put off selling their homes to avoid taking on a new mortgage at a higher rate. In the Fannie Mae study, 84% of respondents said the lock-in effect is diminishing and contributing to an increase in listings.

Home listings are surging in the West, up nearly 40% in San Jose, Calif., 22% in Phoenix, 21% in San Diego and 18% in Denver, according to Redfin data, for the four weeks ending June 2.

Most Read from MarketWatch

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel