Amid the rise of artificial intelligence (AI), Nvidia has emerged as one of the premier stocks. Not only has it developed a technical lead in AI chips, but its chips support the functions of other AI companies, making it all the more essential.

Still, that focus may have induced investors to ignore other AI chip stocks, and one that may deserve more attention is Qualcomm (NASDAQ: QCOM). The leading designer of smartphone chipsets has brought AI innovation to the smartphone, as well as products such as IoT and automotive applications and, more recently, to the personal computer. Given such innovations, investors may want to give more attention to this stock before other prospective buyers take notice.

Qualcomm and AI

As the leading smartphone chipset company in the high-end market, Qualcomm has wholeheartedly embraced AI. The Snapdragon 8 Gen 3 chipset has attracted strong demand, particularly in China. CFO Akash Palkhiwala said on the fiscal Q2 2024 earnings call that in the Chinese market, its smartphone sales increased by more than 40% yearly, likely due to these devices’ generative AI capabilities.

However, as investors know, Qualcomm expanded beyond smartphone chipsets in recent years, and all of these applications incorporate AI. More recently, it has also broken into the CPU space, producing an AI-powered personal computer. To this end, Microsoft has aligned with Qualcomm to build an AI-powered PC, a move that could upend a segment of the industry long dominated by Intel and AMD.

How Qualcomm connects financially

Nonetheless, for all of its potential, the financials seem to better reflect the recent industry downturn than an AI-driven future. In the first six months of fiscal 2024 (ended March 24), its $19 billion in revenue rose by only 3% compared to the same period last year.

Although that is an improvement from the revenue declines of recent years, it is also a far cry from the triple-digit revenue growth of AI market leader Nvidia.

Nonetheless, profitability dramatically improved due to reduced operating expenses. The $5.1 billion net income for the first two quarters of fiscal 2024 grew 29% compared with the same year-ago period.

Fortunately for shareholders, investors seem to have focused more on Qualcomm’s growth potential instead of past performance. Over the last year, the stock has risen by more than 85%, taking it to all-time highs.

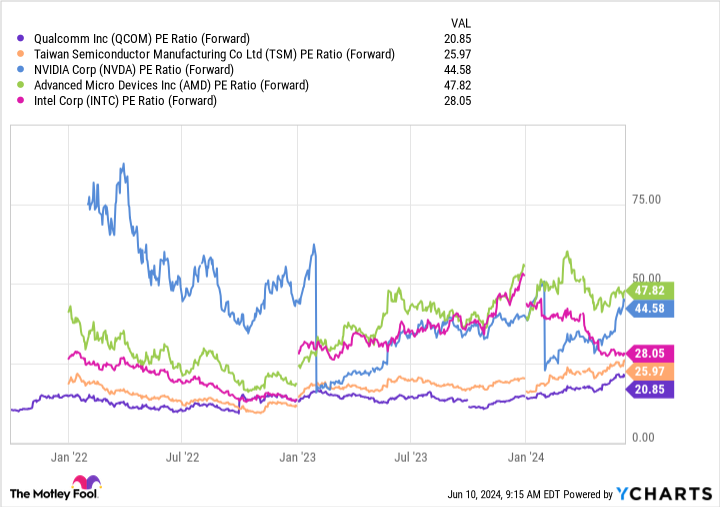

Additionally, even though its 28 P/E ratio rose recently, its earnings multiple is lower than that of its primary manufacturer, Taiwan Semiconductor, and all of the largest AI chip companies. This includes Intel, which has struggled in recent years as it redefines itself.

This dynamic remains true when measured by the forward P/E ratio, as it sells for 21 times forward earnings. Hence, despite the recent gains, it remains an attractive option for semiconductor stock investors, especially with its recent AI innovations.

Buy Qualcomm stock

For shareholders wanting to invest in the AI chip industry at a low valuation, Qualcomm looks like one’s best bet. Thanks to AI, it has reinforced its technical lead in its core industry, smartphone chipsets.

Moreover, AI plays a role in its newer industries, such as IoT and automotive. With the recent introduction of the company’s AI PC chip, Qualcomm could become a major presence in another part of the tech industry. Considering its recent growth and relatively low valuation, the increases will likely continue for the foreseeable future.

Should you invest $1,000 in Qualcomm right now?

Before you buy stock in Qualcomm, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Qualcomm wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $746,217!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Will Healy has positions in Advanced Micro Devices, Intel, and Qualcomm. The Motley Fool has positions in and recommends Advanced Micro Devices, Microsoft, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Nvidia’s Growth Is Explosive, but Here’s Another Artificial Intelligence (AI) Stock That Could Be Worth Buying was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel