Despite covering relatively few stocks, the Dow Jones Industrial Average is often considered a bellwether. Its 30 components have experienced significant change, and even though many slow-growth stocks remain in the index, it also includes many of today’s largest and most dynamic companies.

This means some of the companies in the Dow will continue to fly high. If you want exposure to the Dow and the potential for significant growth, these stocks could serve you well over time.

Amazon

Indeed, Amazon‘s (NASDAQ: AMZN) $1.9 trillion market cap makes growth challenging. It means that it must generate more revenue and profit than much smaller companies to achieve the same percentage growth rates.

However, Amazon has found a unique workaround. Its online sales business, which accounts for its largest revenue source, is a low-margin business supporting smaller, more dynamic enterprises. That includes advertising, subscriptions, and third-party seller services.

Moreover, Amazon Web Services (AWS), its cloud computing business, made up $25 billion of Amazon’s $143 billion in revenue for the first quarter of 2024. Nonetheless, thanks to its higher operating margin, it accounted for $9.4 billion of Amazon’s over $15 billion in operating income.

The AWS segment gives it a much smaller base by which it can grow profits faster. Indeed, the $10 billion in Q1 net income rose 225% from year-ago levels. That increase likely contributed to Amazon’s near-60% stock price surge over the last year.

Furthermore, while the triple-digit profit growth is probably not sustainable, it makes its 51 price-to-earnings ratio, a level near multi-year lows, appear inexpensive. Such conditions should bolster Amazon’s growth despite its size and stability.

Visa

Despite its massive size, Visa (NYSE: V) holds tremendous growth potential. Its global payments network continues to play a more critical role in the economy as society becomes more cashless.

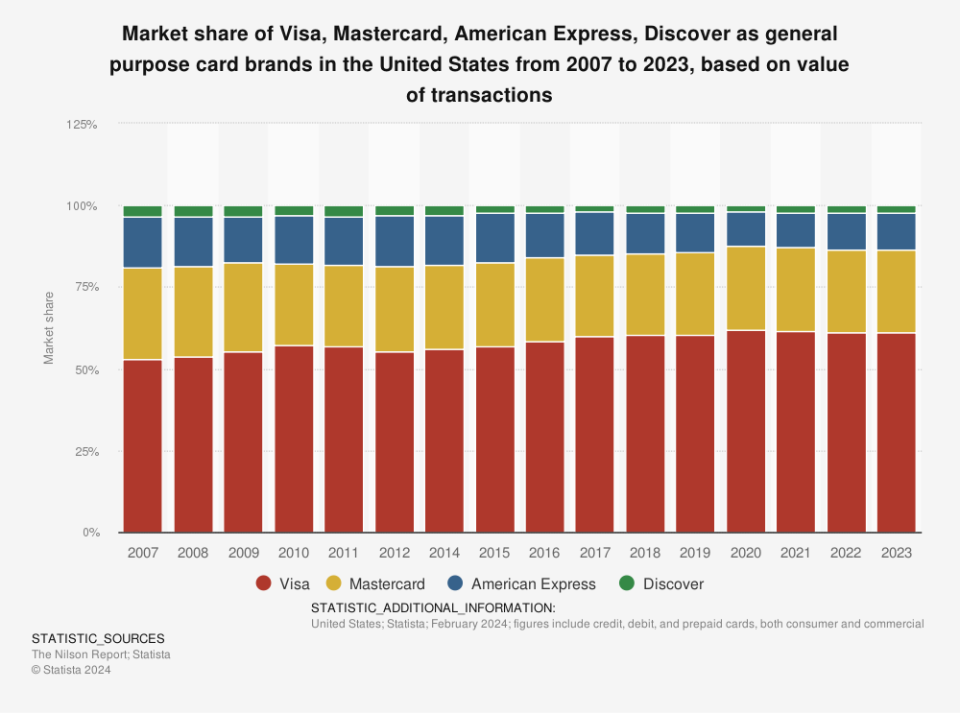

It remains a leading (or arguably dominant) service provider with its credit and debit cards and merchant terminals. In 2023, 61% of all credit cards in the U.S. came from Visa. This was far ahead of Mastercard at 25% and American Express at 11%.

Considering the volume of global transactions, it adds up to a staggering amount of gross payment volume, and from that, Visa collects a small fee.

However, its largest revenue source is data processing fees. That involves services such as clearing, settlement, network access, and other related services. International transaction fees and other services make up the remainder of its revenue.

In fiscal Q2 (ended March 31), Visa reported $8.8 billion in revenue, 10% above year-ago levels. Likewise, its $4.7 billion in net income also rose 10%.

This growth helped take the consumer finance stock more than 20% higher over the last year. Also, its P/E ratio of 31 is below the average multiple of 35 for the last five years, a factor that could attract more buyers. Given industry trends, Visa’s march higher should continue for a long time to come.

McDonald’s

Admittedly, investors may not look favorably at McDonald’s (NYSE: MCD), given concerns over rising prices and wages. Media reports of the feared “$20 happy meal” may have contributed to the restaurant stock moving into correction territory.

However, a $20 happy meal is not likely to happen anytime soon. Even if it were, McDonald’s business model insulates it from those effects. Most of the company’s high-margin revenue comes from building rentals and franchise fees — fixed amounts that do not vary with sales. Also, the 4% to 5% of gross sales due to the company presumably rises with inflation, which mitigates the effects of rising prices.

Indeed, the financials continue to trend higher. In the first quarter of 2024, revenue of $6.2 billion rose 5% compared with year-ago levels. With that increase, the company earned over $1.9 billion, a 7% yearly increase.

Additionally, investors should not forget the $6.68-per-share annual dividend. Its 2.6% dividend yield is around double the S&P 500 average of 1.3%. More importantly, it has risen yearly since McDonald’s introduced the dividend in 1976. That rising return makes it more of a hold, particularly for longtime shareholders.

Furthermore, its P/E ratio of 22 is below the five-year average of 28, allowing prospective shareholders to buy at a discount. As investors recognize that the rising prices are unlikely to derail McDonald’s, they will likely have a more bullish outlook on the stock.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $671,728!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 28, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. American Express is an advertising partner of The Ascent, a Motley Fool company. Will Healy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Mastercard, and Visa. The Motley Fool recommends the following options: long January 2025 $370 calls on Mastercard and short January 2025 $380 calls on Mastercard. The Motley Fool has a disclosure policy.

These 3 Dow Stocks Are Set to Soar in 2024 and Beyond was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel