It’s said that timing is everything.

Many investors might apply this logic to the stock market. It’s true that a well-timed investment can create millionaires, and poorly-timed investments can wreck fortunes. However, the quality of the investment is more important than timing. A high-quality investment could continue strong growth and even outperform for years to come.

The S&P 500 and Nasdaq Composite are each up more than 10% year to date, but some stocks have performed far better than those indexes.

A panel of Motley Fool contributors examined Nvidia (NASDAQ: NVDA), Qualcomm (NASDAQ: QCOM), and Robinhood Markets (NASDAQ: HOOD), which have rallied between 43% and 133% year to date. Is it time to buy, sell, or hold? Let’s find out.

Nvidia could end 2024 as the world’s largest company

Jake Lerch (Nvidia): This year has been a banner year for Nvidia. The company’s shares are up a staggering 133% year to date. Its market cap of $2.8 trillion trails only two other American companies (as of this writing): Microsoft ($3.2 trillion) and Apple ($2.9 trillion). What’s more, it’s quickly closing the gap on those two companies. Nvidia may end 2024 as the largest company in the world.

All that said, investors want to know whether there’s still time to buy Nvidia shares. So, let’s evaluate that by the numbers.

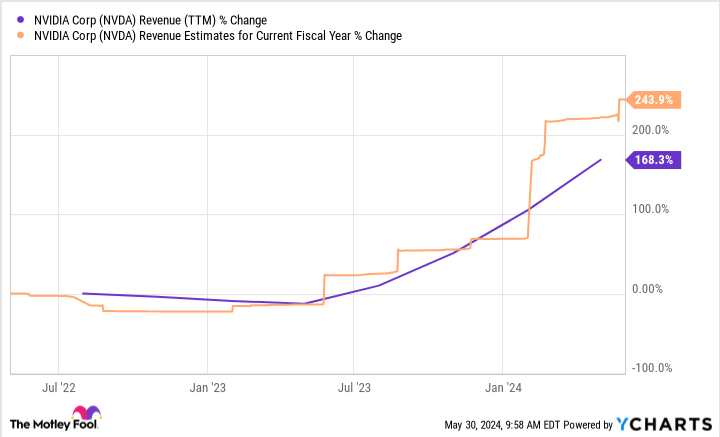

In a nutshell, Nvidia’s shares have exploded because the company is growing so fast. For the last two years, analysts have raced to boost their sales estimates quarter after quarter as Nvidia’s surging revenue keeps climbing higher. Take a look at this chart to see what I mean:

As you can see, Nvidia’s trailing-12-month sales have more than tripled from about $26 billion to almost $80 billion in less than two years. That’s all due to the artificial intelligence (AI) revolution and Nvidia’s role within it as the supplier of AI “brains” — also known as graphics processing units (GPUs). As long as the AI revolution keeps rolling on — and companies keep shoveling massive amounts of money into building out their AI capabilities — Nvidia’s sales will keep growing.

So, will the growth continue?

That is the big question, and no one can truly answer it. However, there are signs that AI spending is still accelerating. Amazon recently announced plans to spend billions of dollars on AI infrastructure — think Nvidia GPUs — for its Amazon Web Services (AWS) division. Elon Musk’s xAI venture is also planning to spend billions on Nvidia GPUs.

To sum up, Nvidia’s enormous price run-up seems justified, given its skyrocketing sales. The AI revolution is likely to continue for years — if not decades — to come. Therefore, long-term investors shouldn’t be scared off by Nvidia’s incredible run. Indeed, it could last well into the future.

It’s time to start watching this overlooked AI chip stock

Will Healy (Qualcomm): Amid the hype surrounding Nvidia in the AI chip space, investors may not have noticed that Qualcomm stock has risen to all-time highs.

This is likely because the company has ventured beyond smartphone chipsets, and one primary focus is the development of AI chips. The Snapdragon 8 Gen 3 has brought on-device AI to an increasing number of smartphones and other types of devices.

In June, it will launch a next-generation AI Windows PC chip powered by its Snapdragon platform, presenting a competitive threat to Advanced Micro Devices and Intel. Also, its AI Hub for developers will bring at-scale commercialization for all these AI applications.

Admittedly, these AI products have barely begun to appear in its financials. Revenue for the first half of fiscal 2024 (ended March 24) came in at $19 billion, rising only 3% versus the same period in fiscal 2023. However, slightly lower operating expenses and higher investment profits led to a net income for the period of $5.1 billion, a yearly increase of 29%.

Such improvements and the focus on AI have probably helped the stock rise by 43% since the beginning of 2024. Still, that rising stock price has also taken the P/E ratio to 28, its highest earnings valuation in more than three years.

That higher earnings multiple may leave investors wondering whether they are too late, especially considering the company’s forecast for a 15% increase in earnings per share at the midpoint. When taking into account that level of predicted profit growth and the rising P/E ratio, the semiconductor stock appears to sell for close to fair value.

However, Allied Market Research estimates a compound annual growth rate (CAGR) for AI chips of 38% through 2032. If AI chips become more of a catalyst for Qualcomm’s revenue growth, investors could find themselves wishing they had bought the stock at its current valuation.

Robinhood stock is up 65% since January and could keep going higher

Justin Pope (Robinhood Markets): The good news keeps rolling in for investors in Robinhood Markets. The growing digital brokerage and fintech company recently announced a $1 billion share repurchase program that signals a tremendous vote of confidence in the company’s future. But don’t just take my opinion for it; let’s look at the facts.

Robinhood began lobbying for investors’ retirement funds early last year when it launched retirement accounts. Retirement assets under management took about a year to grow to $4 billion (as of the end of March 2024). However, retirement assets have skyrocketed to over $8 billion in under two months since then. CEO Vlad Tenev took to social media to announce the update. In other words, retirement assets took one year to reach $4 billion and two more months to double.

The company was profitable according to generally accepted accounting principles (GAAP) in the first quarter, and that could be an ongoing trend as assets continue accumulating on the platform. Many investors could argue that Robinhood, which remains a small player in its field, is a growth stock and that a share repurchase program doesn’t make sense. On the other hand, it could signal that management believes the stock is too cheap to ignore — even after a 65% run.

Analysts believe earnings could grow by an average of 11% annually over the long term, but those figures could eventually prove too conservative if Robinhood’s momentum in attracting users’ funds to its platform continues. Investors may see shares take a breather at some point. After all, a 65% move is no joke. Still, Robinhood’s growth story could just be starting, which makes it a great pick for long-term investors.

Should you invest $1,000 in NASDAQ Composite Index right now?

Before you buy stock in NASDAQ Composite Index, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and NASDAQ Composite Index wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $713,416!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 3, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jake Lerch has positions in Amazon and Nvidia. Justin Pope has no position in any of the stocks mentioned. Will Healy has positions in Advanced Micro Devices, Intel, and Qualcomm. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Apple, Microsoft, Nvidia, and Qualcomm. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

Up 43% to 133%, Is It Too Late to Buy These 3 Stocks? was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel