Investors love tobacco stocks because of their high dividend yields and growing dividend payouts. Long-term shareholders in these companies have made a fortune by simply holding and watching the dividend payments pile up in their accounts.

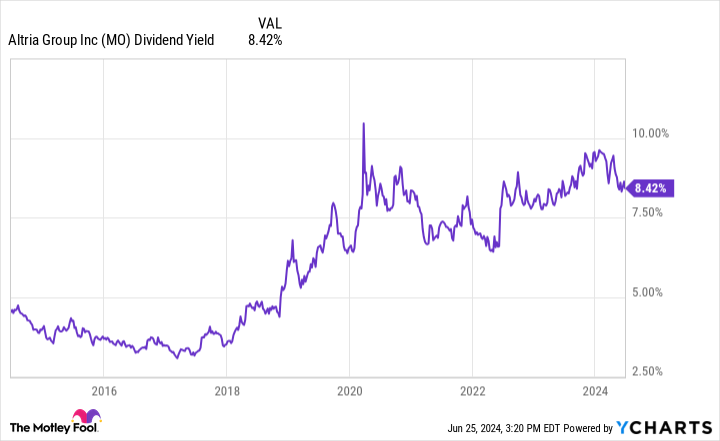

Today, Altria Group (NYSE: MO) has a dividend yield of 8.43%. The United States-focused tobacco giant can generate $1,000 in annual dividend income for investors who buy $11,862 worth of stock right now. But is this dividend sustainable? Is Altria Group a safe dividend stock today?

I think it is. Here’s why Altria Group is a smart play for investors looking to build a diversified dividend income portfolio.

Volume declines, but rising new categories

Altria Group owns the U.S. brand of Marlboro, which is the top premium cigarette in the country with around 40% market share. This dominance has been retained for decades. However, investors are worried about accelerating overall volume declines in the cigarette category, which has caused stocks such as Altria to underperform the market.

For example, last quarter Altria estimated that cigarette volumes declined by 9% year over year for the entire U.S. market. Despite this, the company’s net revenue for smokeable products only declined by 2.3%, with segment operating profit declining by a similar amount as well. While this isn’t an ideal situation, Altria has been able to raise prices to counteract volume declines for decades to maintain profits.

Smokeable products are the majority of Altria’s $11.4 billion in operating profits today, but they’re increasingly getting replaced by new nicotine products in vaping and nicotine pouches. The company’s recent acquisition of the Njoy brand has a market share of 4.3%, which grew by 0.6 percentage points last quarter. Now, the U.S. government and law enforcement are increasing crackdowns on illegal vaping devices, which should help Njoy greatly increase market share.

On top of this, the On! nicotine pouch brand grew shipment volumes by 32% year over year last quarter. It is still a tiny part of the brand portfolio but should continue to grow quickly. It might help too that the largest competitor in nicotine pouches, Zyn, is seeing supply shortages in the United States right now.

The dividend is not only safe, but can grow

Recent 9% volume declines and a 2% decrease in profits for the smokeable category are concerning for investors. However, running the math on Altria’s dividend payout shows the 8%+ dividend yield is here to stay.

Over the last 12 months, Altria has paid a dividend per share of $3.88. Free cash flow per share — the fuel for dividend payments — was $5 and has been consistently above the dividend per share for the last five years. Altria is also reducing its shares outstanding through a stock buyback program, which has brought shares outstanding down by a cumulative 8% in the last five years.

Having 8% fewer shares means an 8% lower cumulative dividend payout while maintaining the same dividend per share level. It also helps free cash flow per share grow, even if nominal free cash flow is flat. So, even if Altria’s earnings stagnate due to heavy volume declines, the company has plenty of room to grow its dividend per share due to the wide spread between its dividend payout and free cash flow along with the consistent buyback program.

Is the stock a buy?

With such a high dividend yield, I think contrarian investors looking to build retirement income are smart to buy Altria Group stock today. Its dividend yield has gone from less than 4% to over 8% in the last 10 years as the stock has suffered. But the business is still in fine shape and has the earnings power to maintain a growing dividend over the next five years and beyond.

Buying a little over $11,000 of Altria stock can deliver $1,000 in dividend income to your portfolio every year. Investors should remember to diversify their holdings, though. If $11,000 is a large investment for you, start with a smaller amount and build up your dividend income by buying more shares over time. It is never smart to go all in on one stock, as no company is a risk-free investment. The same holds true for Altria and any other tobacco stock.

With investors piling into technology and AI stocks at huge earnings multiples, it may be smart to zig while others are zagging and buy some high-dividend-yield stocks like Altria Group in 2024.

Should you invest $1,000 in Altria Group right now?

Before you buy stock in Altria Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Altria Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $759,759!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 24, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Want $1,000 in Super-Safe Dividend Income? Buy $11,862 of This Ultra-High-Dividend Yield Stock was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel