Warren Buffett is the head of Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B). Since 1965, he has steered the investment company to a mind-boggling return of 4,384,748%, which could have turned $1,000 into more than $43 million. By comparison, the same investment in the S&P 500 would have returned just $312,230 over the same period.

Berkshire wholly owns a number of private companies, like GEICO, Dairy Queen, and Duracell. But it also manages a portfolio of 47 publicly-listed stocks and securities worth $372.3 billion, which includes holdings in Apple, Coca-Cola, and Bank of America.

Berkshire spent approximately $38 billion accumulating shares of Apple since 2016. It has sold some along the way, but its holding is now worth a whopping $150.2 billion, representing 40.3% of the conglomerate’s portfolio. It’s Berkshire’s largest position by a wide margin.

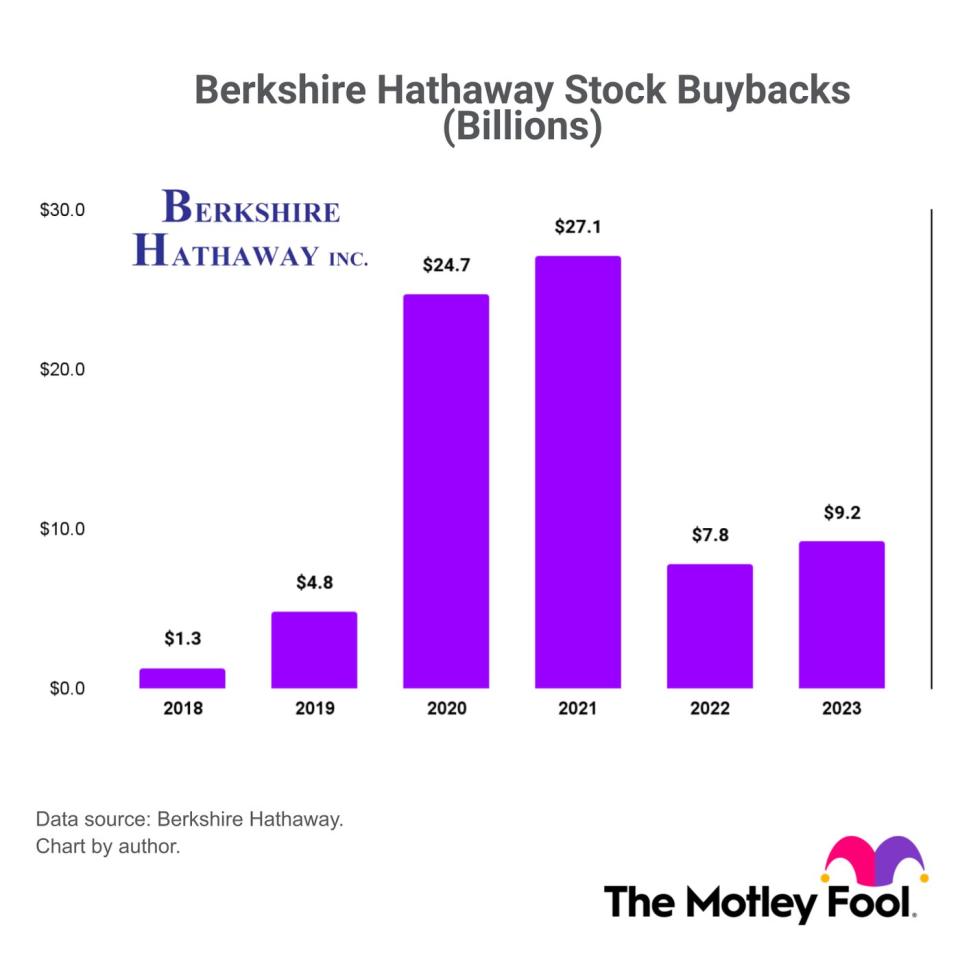

However, it spent almost twice as much — $75 billion — buying shares of another company between 2018 and 2023: Berkshire Hathaway.

Stock buybacks are a popular way for companies to return capital to shareholders. Berkshire was sitting on a $189 billion cash pile as of Mar. 31, and it’s not easy for a company this size to find quality investments large enough to move the needle. As a result, Buffett has opted to spend some of it on buybacks.

Berkshire spent a further $2.6 billion buying back stock during the first quarter of 2024, bringing the total to $77.5 billion since 2018. And it will probably continue to repurchase shares for the foreseeable future.

You might say Buffett is betting billions of dollars on himself. With his stellar 58-year track record, why wouldn’t he?

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $677,040!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 28, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Bank of America, and Berkshire Hathaway. The Motley Fool has a disclosure policy.

Warren Buffett’s Berkshire Hathaway Has Spent $77.5 Billion Buying This Stock Since 2018 was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel