I have an affinity for collecting passive income. I like to see dividend and interest payments deposited into my account. I currently reinvest that cash into generating more income so that I can eventually achieve my goal of producing enough passive income to cover my recurring expenses.

One of my favorite income-generating vehicles is the JPMorgan Equity Premium Income ETF (NYSEMKT: JEPI). The exchange-traded fund (ETF) pays a hefty monthly distribution (the latest payment was at a nearly 7% yield). That’s one of the many reasons I continue adding to my position in the passive income machine.

A premium income strategy

JPMorgan Equity Premium Income ETF’s aim is simple yet ambitious. It strives to deliver distributable monthly income and equity market exposure with less volatility than the S&P 500. To achieve that goal, it utilizes a two-pronged strategy.

The equity market upside comes from holding a defensive portfolio of high-quality stocks. The ETF’s managers use a bottom-up research process to pick stocks based on their proprietary risk-adjusted rankings. The ETF holds around 100 stocks led by:

The managers take more of an equal-weighted approach. On the one hand, that helps mute the potential negative impact of underperformance among its top holdings. For example, being underweight Boeing relative to the S&P 500 (0% weighting in the fund) added to its results during the first quarter when the aerospace giant underperformed. Meanwhile, its higher weighting to Progressive added to its returns in the period.

This stock portfolio supplies equity-like returns (and some dividend income) with less risk than the S&P 500, given its focused yet balanced exposure to the highest-quality companies in that index.

The other aspect of its strategy is writing out-of-the-money call options on the S&P 500. This strategy generates options premium income that the fund can distribute to investors each month. The premium income it generates is higher during periods of volatility, which helps smooth out returns.

An enticing income stream (and more)

The ETF has certainly delivered a premium supply of income to fund investors. Its last monthly distribution payment put its income yield at around 7%, while its rolling 12-month yield is approaching 8%. Its latest payment offered nearly as much income as investors can earn from high-yield junk bonds (7.7%). Meanwhile, it generates much more income than investors could earn from REITs (4.3% average yield) and the S&P 500 (1.3% dividend yield).

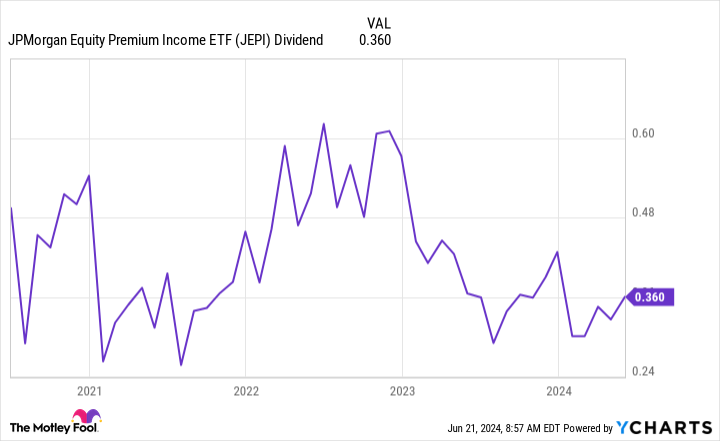

While bonds offer a fixed income stream, the monthly distribution from this ETF can vary significantly:

The payout tends to be higher following periods of market volatility because it causes options premiums to rise.

In addition to offering an income stream that rivals junk bonds, this ETF provides something that bonds can’t match: equity upside exposure. The fund’s portfolio of high-quality stocks tends to rise in value over the long term. Add that price appreciation to the ETF’s monthly income distributions, and the total return has averaged 12.5% annually since the fund’s inception in 2020. That’s a strong return from an income-focused investment.

The fund probably won’t outperform the S&P 500 during strong markets (the S&P 500’s annualized total return is 18.2% since the ETF’s formation in mid-2020). However, its value won’t decline as steeply as the broader market during corrections due to its more defensive portfolio and ability to cash in on volatility by selling call options on the S&P 500. That enables it to provide some equity upside potential with less downside risk compared to the S&P 500.

A compelling combination

JPMorgan Equity Premium Income ETF is becoming one of my favorite vehicles for generating passive income. The fund pays a lucrative monthly income stream. It also offers equity upside potential with less downside risk. That combination of income and upside makes it a great fit for my portfolio since it should grow my income and wealth in the coming years.

Should you invest $1,000 in JPMorgan Equity Premium Income ETF right now?

Before you buy stock in JPMorgan Equity Premium Income ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and JPMorgan Equity Premium Income ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $775,568!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 24, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Matt DiLallo has positions in Amazon, JPMorgan Equity Premium Income ETF, and Meta Platforms. The Motley Fool has positions in and recommends Amazon, Meta Platforms, and Microsoft. The Motley Fool recommends Progressive and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Why I Can’t Seem to Get Enough of This Ultra-High-Yielding Dividend S&P 500 ETF was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel