Markets seem poised to end the week on a high note with both the S&P 500 and Dow Jones Industrial Average inching up after a rocky trading session yesterday.

But several electric vehicle (EV) stocks are charging considerably higher today with investors believing that Chinese EV manufacturers might be ready to make a greater push into the market with more-affordable models.

investors are pressing the accelerator pedal on shares of Nio (NYSE: NIO), Li Auto (NASDAQ: LI), and XPeng (NYSE: XPEV). As of 12:22 p.m. ET on Friday, shares of Nio were up 8.8%, while shares of Li Auto and XPeng were up 6.6% and 10.5%, respectively.

Driving in a new direction

Speaking with CNBC yesterday, executives at Nio and XPeng both said that they’re committed to providing more moderately priced vehicles in 2024. Specifically, CEO William Li of Nio told the cable network that the company will offer an SUV that’s less expensive than Tesla‘s Model Y.

XPeng expects to debut its more economical Mona in the coming months, according to co-president Brian Gu.

Nio’s comments won’t come as a surprise for those who follow the company closely. On the recent fourth-quarter 2023 conference call, Li referred to the more family-focused model scheduled to be launched in the second half of the year. Waxing optimistic, Li said:

“[The new model] is targeted at the mass market and also for the family oriented users where the competition is also more intense. But luckily, it can leverage the existing electrification and smart technologies and infrastructures already developed by Nio. So it has certain advantages than starting a completely new brand from the ground up. For this second brand, we will focus in more — we will be focusing more on the volume.”

Similarly, XPeng also sees the launch of the Mona as an auspicious opportunity. On Xpeng’s fourth-quarter 2023 conference call, James Wu, vice president for finance and accounting, expressed the belief that XPeng’s partnership with transportation company DiDi will be advantageous.

It seems that investors are bidding Li Auto higher in sympathy with Nio and Peng, whose apparent recognition of the market for more-moderately priced vehicles likely has investors optimistic that Li Auto will also benefit from growing demand for its flagship family SUV.

Is now the time to power your portfolio with these EV stocks?

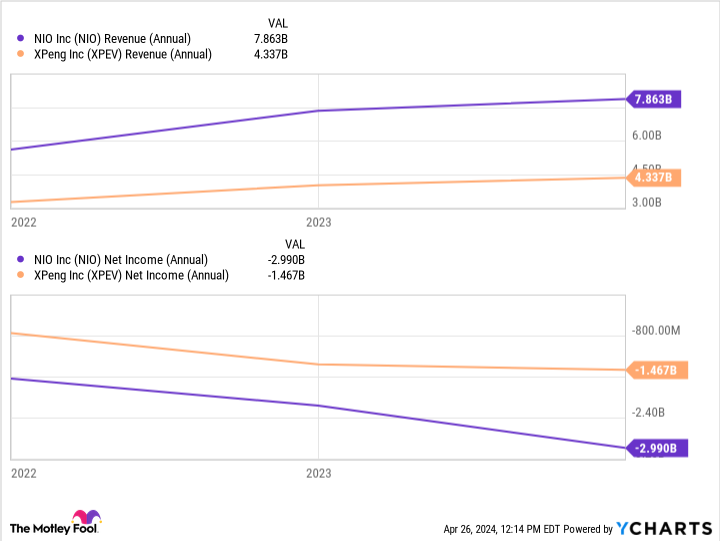

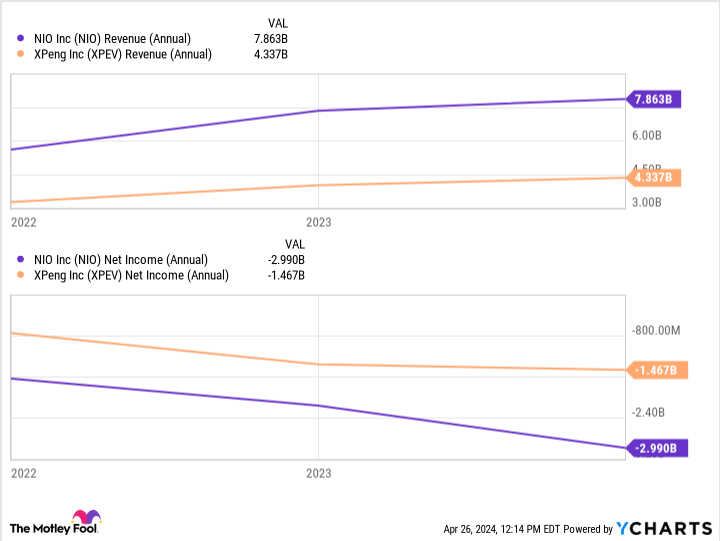

While many investors are interpreting the news from Nio and XPeng as a green light to buy the stocks, both companies’ new approaches should be taken with some grains of salt. The two companies have both succeeded in growing revenue but have also experienced increasingly steeper net losses.

Unless investors are comfortable with a fair amount of risk, now doesn’t seem like the best time to click the buy buttons on Nio and XPeng. Li Auto, however, has generated positive net income over the past four quarters, suggesting it could be a better fit for EV investors looking to reduce risk.

Should you invest $1,000 in Nio right now?

Before you buy stock in Nio, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nio wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $506,291!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 22, 2024

Scott Levine has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nio and Tesla. The Motley Fool has a disclosure policy.

Why Shares of EV Stocks Nio, Li Auto, and XPeng Are Racing Higher Today was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email [email protected] Follow our WhatsApp verified Channel