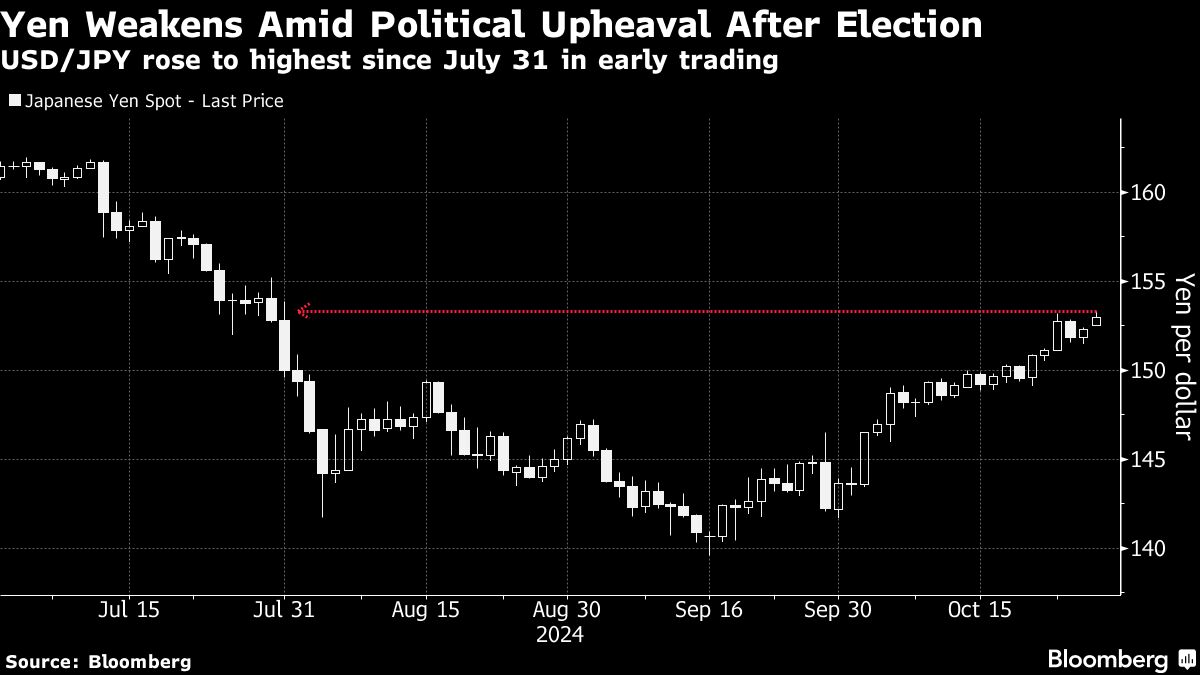

(Bloomberg) — The yen fell after Japan’s ruling coalition failed to win a majority in parliament, stoking speculation the political uncertainty would make the central bank less hawkish. Crude declined after Israeli strikes on Iran avoided oil facilities.

Most Read from Bloomberg

The Japanese currency dropped as much as 1% to 153.88 per dollar Monday, the weakest level in about three months, after a gamble by Prime Minister Shigeru Ishiba to call a snap election backfired. The weaker yen, which benefits the nation’s export-oriented economy, helped push the Topix index up by as much as 1.6%. US equity futures rose.

Much of the yen’s weakness reflects the ultra-low level of interest rates in Japan relative to the US and other major economies. This wide gulf is unlikely to change significantly anytime soon, with the Bank of Japan widely expected to keep its policy interest rate unchanged at a meeting that concludes Thursday.

“The likelihood of a minority government in Japan is the new and critically important factor for markets going ahead,” according to Masahiko Loo, senior fixed income strategist at State Street Global Advisors. “In this period of uncertainty, we look for a potential positive externality: a larger and more populist fiscal package (at least on surface), irrespective of the coalition outcome.”

Elsewhere in Asia, Chinese shares edged lower after profits at industrial firms plunged in September, a challenge to the economy as deflationary pressures sap the strength of corporate finances. Meanwhile, China’s central bank unveiled a new tool to help it better manage liquidity.

Crude plunged after Iran said its oil industry was operating normally after Israel struck military targets across the country. Brent crude dropped and West Texas Intermediate fell by more than 5% in early trading before paring declines. Gold edged lower.

Crucial Stretch

Markets are readying for a barrage of data this week including Chinese economic activity readings, Eurozone and US growth prints as well as a payrolls report to help position portfolios into year-end.

“As the elections approach and Trump trades increasingly are implemented, the US dollar may remain on the front foot while US rates remain elevated, creating a somewhat painful backdrop for emerging market assets,” Barclays Plc strategists led by Themistoklis Fiotakis wrote in a note to clients. While it may worsen in a Trump win, “there has already been some degree of election premium built into currency markets over recent weeks.”

For the US bond market, already stung by the worst selloff in six months, the coming days will be particularly crucial, as they feature the Treasury Department’s announcement on Wednesday on the scale of its coming debt sales.

The rally in stocks faded Friday, with the S&P 500 notching its first weekly loss in seven weeks as a gain in tech stocks failed to offset a drop in bank shares. Five of the so-called Magnificent Seven report earnings this week and are expected to post their slowest collective quarterly earnings expansion in six quarters, according to data compiled by Bloomberg Intelligence.

Elsewhere in Asia this week, major Chinese banks will release earnings reports while the Bank of Japan will give a policy decision. Australia’s inflation data and the official and private Chinese PMI readings will also be closely parsed to help gauge the outlook on the risk-sensitive Aussie and NZ currencies.

Some of the key events this week:

-

Bank of Canada Governor Tiff Macklem speaks, Monday

-

Japan unemployment, Tuesday

-

US job openings, Conference Board consumer confidence, goods trade, Tuesday

-

Alphabet, HSBC, Santander earnings, Tuesday

-

Australia CPI, Wednesday

-

Eurozone consumer confidence, GDP, Wednesday

-

Germany GDP, CPI, unemployment, Wednesday

-

UK Chancellor of the Exchequer Rachel Reeves presents budget to Parliament, Wednesday

-

US GDP, ADP employment, Wednesday

-

Meta, Microsoft, UBS, Volkswagen earnings, Wednesday

-

US Treasury Department holds quarterly refunding announcement of bond-auction plans, Wednesday

-

Australia retail sales, Thursday

-

China Manufacturing and non-manufacturing PMI, Thursday

-

Eurozone CPI, Thursday

-

Bank of Japan policy decision, Thursday

-

US PCE data, Thursday

-

Canada GDP, Thursday

-

Amazon, Apple, Samsung earnings, Thursday

-

China Caixin manufacturing PMI, Friday

-

UK S&P Global Manufacturing PMI, Friday

-

US nonfarm payrolls, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 0.4% as of 12:51 p.m. Tokyo time

-

Nikkei 225 futures (OSE) rose 1.4%

-

Japan’s Topix rose 1.2%

-

Australia’s S&P/ASX 200 was little changed

-

Hong Kong’s Hang Seng fell 0.3%

-

The Shanghai Composite rose 0.2%

-

Euro Stoxx 50 futures rose 0.2%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.2%

-

The euro fell 0.1% to $1.0785

-

The Japanese yen fell 0.8% to 153.60 per dollar

-

The offshore yuan was little changed at 7.1407 per dollar

Cryptocurrencies

-

Bitcoin was little changed at $67,641.26

-

Ether fell 0.7% to $2,470.6

Bonds

Commodities

-

West Texas Intermediate crude fell 4.5% to $68.58 a barrel

-

Spot gold fell 0.6% to $2,731.20 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Michael G. Wilson and Hideyuki Sano.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel