2024 has gotten off to quite the start. As investors warm up to the idea that a new bull market has begun, interest has flooded into the semiconductor industry, with names like Nvidia and Advanced Micro Devices and their artificial intelligence (AI) system assembler partner Super Micro Computer skyrocketing.

Small-cap stock ACM Research (NASDAQ: ACMR) has gone wild, too, up 50% so far in 2024 alone and up some 270% since the beginning of 2023 (as of March 6, 2024). The chip manufacturing equipment company has picked up steam on a better-than-expected growth and profit outlook. But can the run continue?

An odd business model, hidden by a stellar stock chart

The U.S. has been tightening export controls to China on the most advanced semiconductors used in AI systems, as well as the most advanced equipment used to manufacture said semiconductors. Besides these AI chips, though, there’s a world of other types of semiconductors needed for things like electric vehicles and industrial machinery. China has been building its own chip manufacturing industry in support of these more “mature” types of not quite cutting-edge chips.

Enter ACM Research (ACMR), which provides critical equipment for chip manufacturing. Specifically, ACMR provides machines that “clean” silicon wafers between manufacturing process steps. Everything from power management devices to sensors to more basic logic and memory go through dozens of steps before the silicon wafers are cut up into chips. ACMR can help facilitate nearly all of these steps, regardless of the individual processes for each type of semiconductor.

The company’s sales rocketed 43% higher in 2023 to $558 million, including a 56% year-over-year increase in sales in Q4. That’s impressive, given ACMR’s equipment type is dominated by industry giants like Lam Research and Tokyo Electron. Management believes revenue will rise as much as another 30% in 2024, and reach a range of $650 million to $725 million.

But here’s where some oddities come into play. Though it’s a Silicon Valley-based business, ACMR operates through a majority-owned subsidiary called ACM Shanghai (which had an initial public offering in China a few years ago) that accounts for nearly all of the company’s sales. ACMR is quite transparent about this, pointing this fact out at the top of its investor relations homepage.

At this point, there’s no reason to believe that ACMR is skirting U.S. export controls, given that most of its machines are used for those more “mature” chips versus those used in AI. Nevertheless, geopolitical risk (or perhaps the threat of it at some point) does pose a particular reason for concern for would-be ACMR investors.

Is it too late to buy this semiconductor stock?

Geopolitical intrigue aside, ACMR is making solid financial progress. Shares trade for 24 times trailing-12-month earnings per share (EPS), and just 19 times EPS based on Wall Street’s consensus estimates for 2024. For such a fast-growing business, even one that participates in the highly cyclical semiconductor manufacturing space, ACMR looks cheap.

And given investor appetite for all things semiconductors right now, it’s hard to call a top in stocks like ACMR. The market is eyeing long-term potential for the industry, as China, the U.S., and other countries are all trying to onshore semiconductor manufacturing in the wake of the pandemic. ACMR could be sitting on years of growth as a result.

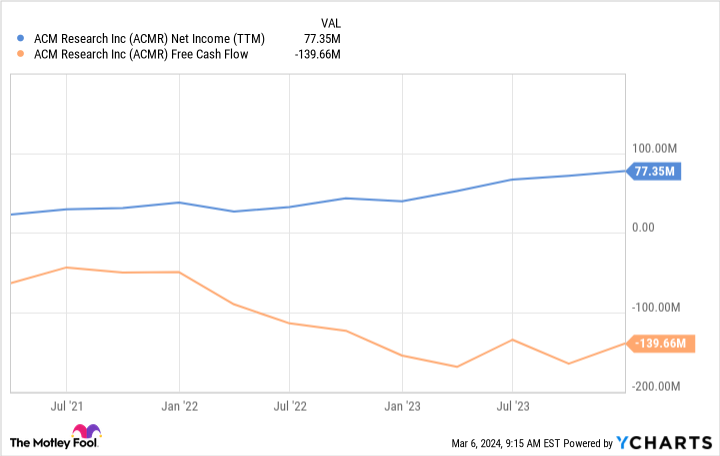

Do bear in mind that said growth does come at a cost. ACMR has been operating in the red on a free-cash-flow (FCF) basis, as its rapid pace of expansion has it spending cash. Note that generally accepted accounting principles (GAAP) net income and EPS are positive because capital expenditures used to calculate FCF are amortized over time.

At any rate, there are plenty of reasons for optimism for this stock. I’m sitting on my hands given the heightened political uncertainty, but ACM Research is nevertheless a fascinating story to watch unfold.

Should you invest $1,000 in ACM Research right now?

Before you buy stock in ACM Research , consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ACM Research wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 8, 2024

Nicholas Rossolillo and his clients have positions in Advanced Micro Devices and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Lam Research, and Nvidia. The Motley Fool recommends Super Micro Computer. The Motley Fool has a disclosure policy.

1 Small Semiconductor Stock Up 50% in 2024 Alone — Is It Too Late to Buy? was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email [email protected] Follow our WhatsApp verified Channel