Not all stocks are created equal. While a few companies hold the potential to become the next Apple or Home Depot, many others will underperform the S&P 500 — or even fall to $0.

Even companies that appear successful can eventually fall flat with investors. Such is the case with Alibaba (NYSE: BABA). Despite being called “the Amazon of China,” it has seen nearly all its gains since 2016 effectively wiped out. With the continuing troubles Alibaba faces, it is not worthwhile for investors to take a chance on this internet and direct marketing retail stock. Here’s why.

The challenges of owning Alibaba stock

Admittedly, even stocks like Amazon face challenges and occasionally lose a large portion of their value in a down (or bear) market. In such cases, more savvy investors will take advantage of such situations and buy at a discounted valuation. That’s not necessarily the issue I have with Alibaba.

And Alibaba’s status as an international stock is not necessarily a red flag. Alibaba trades using American depositary receipts (ADR) rather than actual stock certificates, but that’s also true of well-respected stocks such as Taiwan Semiconductor Manufacturing. Even though ADRs are shares in holding companies and not the enterprises themselves, they tend to serve as excellent proxies for investing in foreign companies.

The biggest reason I’m avoiding Alibaba is the issue of outsized political risk. Part of that relates to U.S.-China relations deteriorating over the last several years, placing shareholders in a precarious position. An example of this arose in 2022 when the SEC threatened many ADR companies with a delisting if they did not offer more complete financial disclosures. The Chinese government was requiring China-based companies to be more secretive about certain facts regarding how their companies were run. China eventually relented and allowed the disclosures, but this shows how seemingly unrelated political events can negatively affect a stock.

Another example of political risk involved Alibaba falling out of favor with the Chinese communist government because of comments made by then-CEO Jack Ma that government officials didn’t like. The government enacted harsh policy changes in retaliation that directly impacted Alibaba’s operations at the time. Such arbitrary changes by an all-powerful government entity meant to punish add to uncertainty about a company. Markets tend to hate such uncertainty.

Growth and Alibaba stock

Then there is the fact that Alibaba stock has failed to capitalize on the growth of Alibaba as a company. The degree of the downturn indicates that the problems go well beyond market sentiment.

In fiscal 2014, Alibaba reported about 127 billion renminbi ($18 billion) in revenue. By fiscal 2023 (ended March 31, 2023), revenue had grown to 869 billion renminbi ($127 billion). Also, the increases continue despite the negative sentiment. In the first half of fiscal 2024, Alibaba earned 459 billion renminbi ($63 billion) in revenue. That translated into 85 billion renminbi ($12 billion) in non-GAAP net income, growing 33% from year-ago levels.

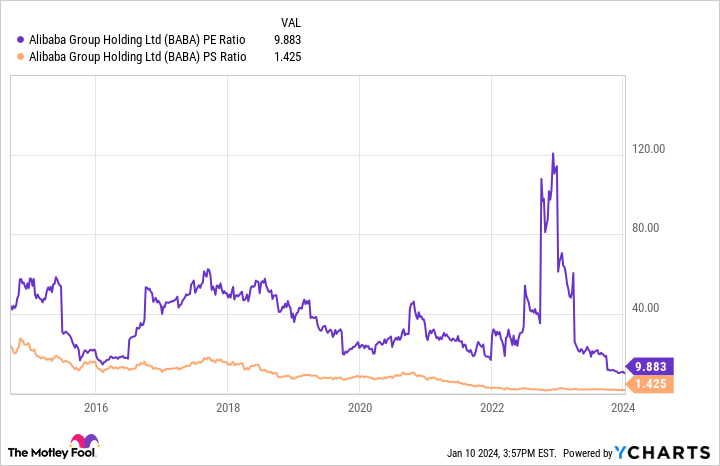

Given the long-term improvement, it is quite remarkable that the stock sells for barely above its 2014 IPO price. Consequently, the price-to-sales (P/S) ratio, which had reached as high as 28 soon after its IPO, has fallen to about 1.4.

Also, the P/E ratio, which was close to 60 in Alibaba’s early days, now stands at just 9.9 times earnings. Given the political turmoil surrounding this stock, it’s easy to see why investors have passed on it despite a rock-bottom valuation.

Avoid Alibaba stock

Despite considerable growth and a low valuation, the level of political risk involved makes Alibaba stock a bad choice for most investors. Although ADR arrangements are typically safe, investors can easily get caught in the middle when the U.S. has strained relations with a company’s home country. The threatened delisting by the SEC highlights such dangers.

Even though a U.S.-based stock like Amazon costs more, it is likely worth paying a premium to avoid unnecessary political risks.

Should you invest $1,000 in Alibaba Group right now?

Before you buy stock in Alibaba Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alibaba Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 8, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Will Healy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Apple, Home Depot, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Alibaba Group. The Motley Fool has a disclosure policy.

1 Stock I Wouldn’t Touch With a 10-Foot Pole — and Here’s Why was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email [email protected] Follow our WhatsApp verified Channel