You make a smart investment in an outstanding business, and it rewards you with bountiful cash returns year after year. Sounds good, doesn’t it?

Passive income is the dream of many investors, but it doesn’t have to be just a fantasy. Here are two high-quality companies that could pay you lucrative cash dividends for the rest of your life.

Enterprise Products Partners

You’d be hard-pressed to find a more reliable dividend stock than Enterprise Products Partners (NYSE: EPD). This energy-services giant has raised its annual cash payout to investors for a quarter-century — and it’s currently offering you a dependable 7% yield.

Enterprise owns and operates a vast network of pipelines, processing plants, and deepwater docks that transport oil and natural gas across North America and to international markets. With its over 50,000 miles of pipelines and 300 million barrels of storage capacity, the energy infrastructure titan plays an essential role in delivering cost-effective fuels and other refined products to its customers.

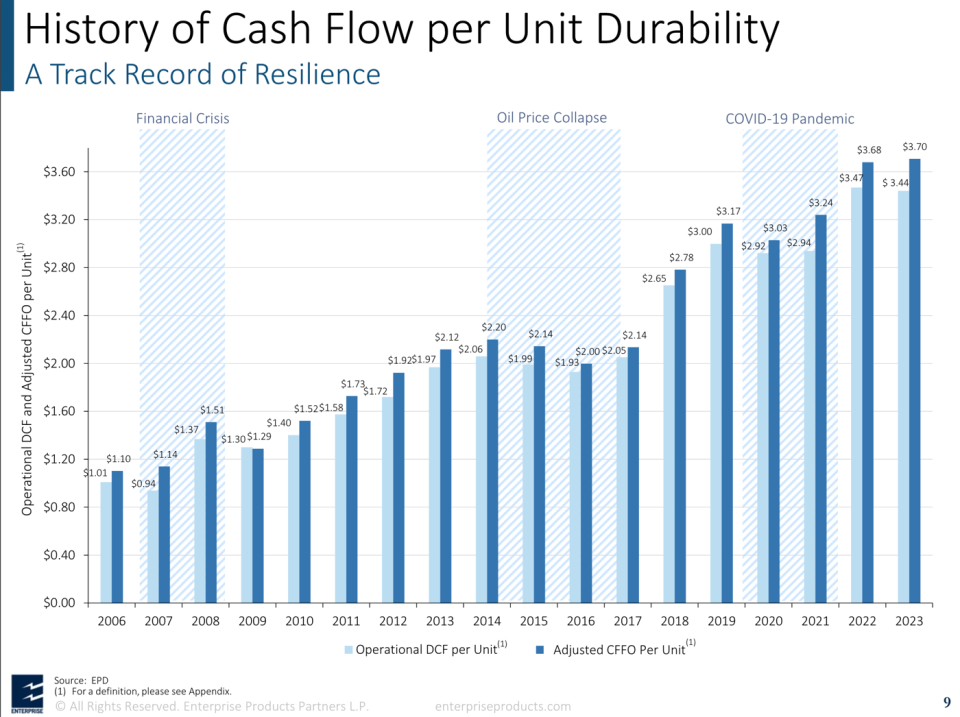

But make no mistake: Enterprise is engineered to be a cash-generating machine. Volume-based contracts and a largely fee-based business model help to insulate the company from the typical volatility in oil and gas prices. In turn, Enterprise can crank out cash flow in nearly any economic environment.

Moreover, as a master limited partnership (MLP), Enterprise was created to pass its profits on to its investors with hefty cash distributions. With $6.8 billion worth of expansion projects set to bolster the company’s cash production, you can expect these payments to continue to increase in the coming years.

Powerful global trends should fuel Enterprise’s long-term expansion. Population growth and rising living standards are projected to boost demand for oil and other petroleum-based products. Additionally, the rapid adoption of artificial intelligence (AI) is expected to lead to increased usage of electricity and, by extension, natural gas. Enterprise intends to supply these vital resources to its customers while delivering consistent dividend growth to its investors along the way.

Ares Capital

If you’d like to build an even larger passive income stream, take a look at Ares Capital (NASDAQ: ARCC). This steadfast dividend stock is offering you a generous 9% yield today.

As the largest publicly traded business development company (BDC) in the U.S., Ares provides private companies with the cash they need to expand. It specializes in loans to “middle-market” businesses that typically have sales of between $10 million and $1 billion. It’s a massive market that accounts for roughly a third of U.S. gross domestic product (GDP) and more than $10 trillion in annual revenue.

Yet these companies tend to be underserved by the traditional banking industry compared to larger corporations. That’s creating a sizable profit opportunity for Ares and its investors. By catering to these overlooked customers, Ares has been rewarded with average yields on its investments of more than 10% in recent years.

Don’t let those sizable returns make you think that this lender is taking on too much risk. Ares prudently lends to high-quality borrowers with strong competitive positions, dependable profits, and proven management. It also wisely diversifies its loans and investments across a range of defensive industries. The BDC leader’s $22.9 billion portfolio held debt and equity positions in 505 businesses as of Dec. 31.

Better still, as a BDC, Ares is required to send at least 90% of its loan and investment income to its investors each year. It’s a proven, wealth-building formula, one that’s delivered market-beating returns of 13% annually to shareholders since Ares’ initial public offering (IPO) in 2004.

Should you invest $1,000 in Ares Capital right now?

Before you buy stock in Ares Capital, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Ares Capital wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $544,015!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 30, 2024

Joe Tenebruso has no position in any of the stocks mentioned. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

2 Ultra-High-Yield Dividend Stocks to Buy Hand Over Fist was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email [email protected] Follow our WhatsApp verified Channel