U.S. Treasury yields have reached their highest levels since mid-November 2023, driven by a mix of economic resilience, persistent fiscal spending and resuming inflationary pressures.

These factors are steering the market’s expectations away from earlier predictions of imminent Federal Reserve rate cuts, significantly impacting the cost of issuing U.S. government debt.

Treasury Bond ETFs Fall To Mid-November 2023 Lows

On Monday, the yield on the 10-year Treasury note hit 4.61%, a peak not observed since Nov. 14, 2023.

This represents a substantial increase of approximately 40 basis points since the beginning of the month.

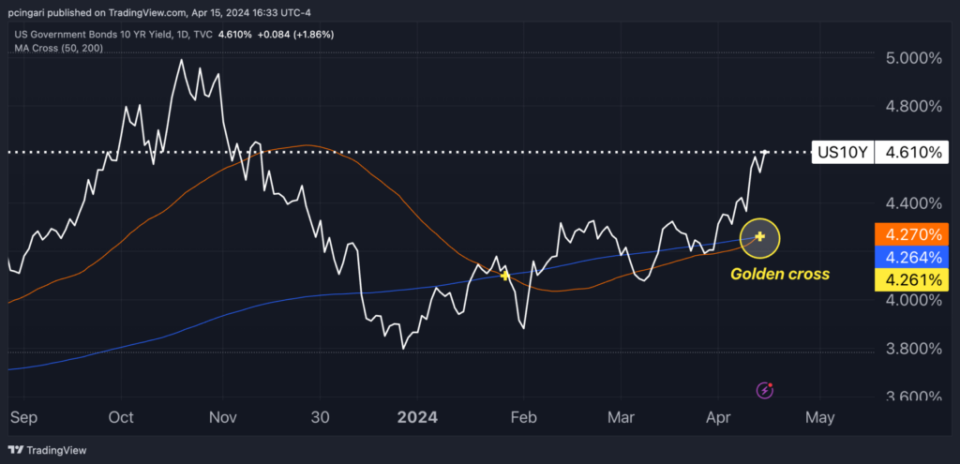

Additionally, the daily chart for the 10-year Treasury yield shows the 50-day and 200-day moving averages have created a “golden cross” pattern, signaling the confirmation of an uptrend and the possibility of further increases, with the next resistance level now projected at 5%.

Concurrently, bond ETFs have experienced notable declines. The iShares 7-10 Year Treasury Bond ETF (NASDAQ:IEF) fell to its lowest level since Nov. 13, 2023, reflecting a 5.6% decrease since its February 2024 high.

The iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) has seen an even steeper drop, falling more than 11% from its January peak.

Chart: US 10-Year Yields For Golden-Cross Pattern

Hot Economic Data Fuels Speculation On Fewer And Delayed Fed Rate Cuts

Recent robust U.S. economic indicators have contributed to a shift in market expectations regarding the Federal Reserve’s actions.

March 2024 saw U.S. retail sales jump unexpectedly by 0.7%, against a forecast of 0.3%. This comes on the heels of higher-than-expected inflation figures and a tighter-than-expected jobs report earlier in the month.

Originally, markets had anticipated the Fed to start reducing rates in June 2024, with a total of three cuts throughout the year. However, current speculations suggest the Fed might only implement a single rate cut this year.

Traders now see only a 20% probability of a June rate cut and the anticipated overall easing for 2024 stands at around 40 basis points, indicating fewer than two quarter-percentage-point cuts.

Analysts Reassess Fed’s Rate Path: UBS Sees Fed Hiking Again

Analysts have quickly adjusted their forecasts on Fed interest rates in response to this shift in economic signals.

A significant caution came from UBS Group AG strategists Jonathan Pingle and Bhanu Baweja, who highlighted the risk of inflation not decreasing to the Fed’s target, potentially necessitating a return to rate hikes and triggering a significant downturn in bonds and stocks.

As reported by Bloomberg, they warned of a possible return to rate hikes if inflation remains above 2.5%, predicting that the Federal Funds rate could reach 6.5% by mid-next year.

The UBS team described a “no-landing scenario” where further rate hikes could lead to a significant flattening of the U.S. Treasury curve and a potential 10%-15% decline in stock market values.

They also forecasted wider credit spreads and a considerable adjustment in market multiples, cautioning that investors are beginning to worry about an overheated economy that could maintain high inflation level.

Photo: Funtap on Shutterstock

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Bond Yields Surge To 6-Month Highs As Likelihood Of No-Landing Scenario Increases: UBS Warns Of Potential Fed Rate Hikes To 6.5% originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel