China’s economy remains resilient despite facing a multitude of headwinds, and global investors should focus on long term opportunities and take advantage of Hong Kong’s role as a “superconnector,” according to government officials and corporate executives.

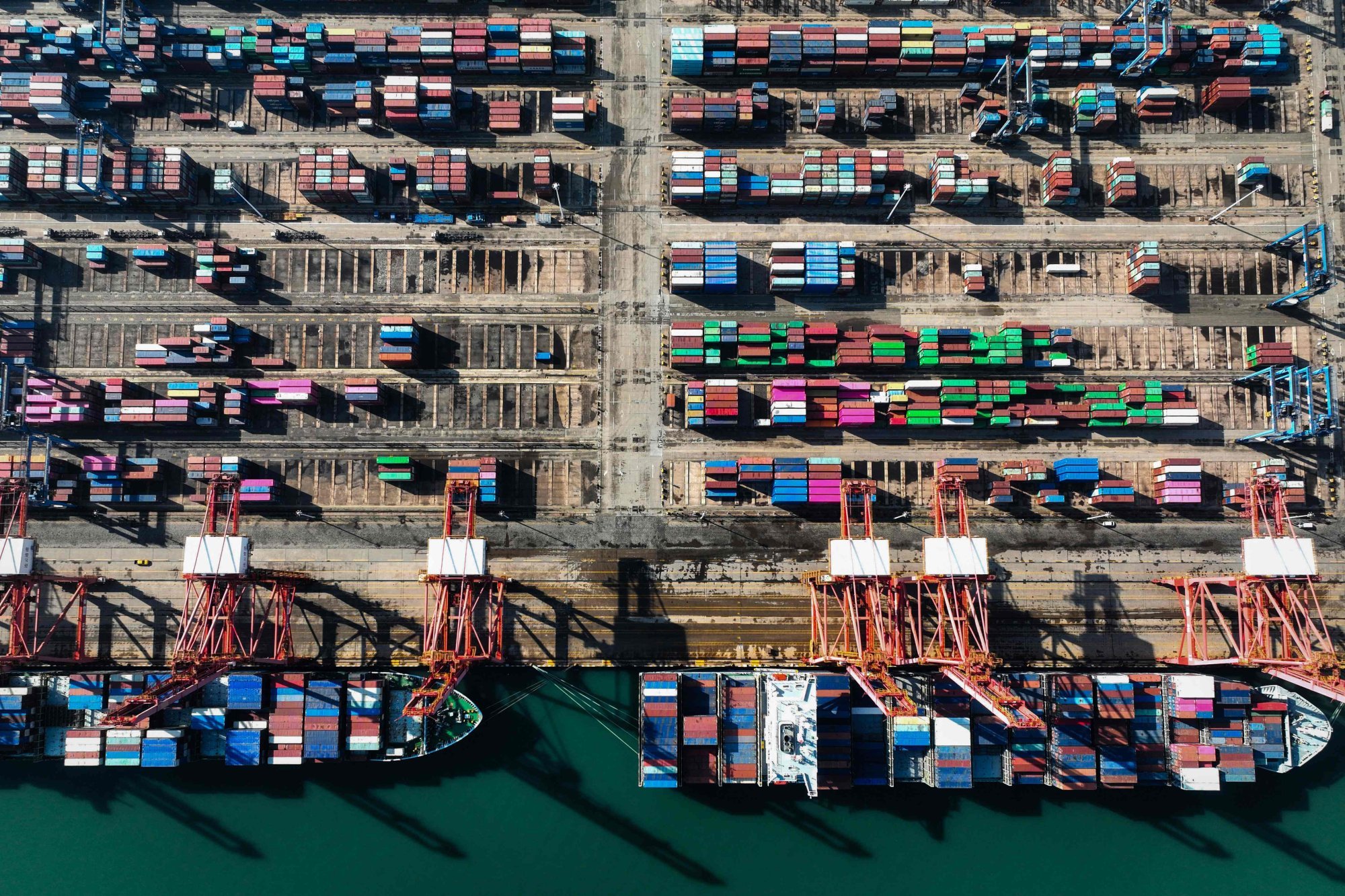

“Hong Kong is the only city in the world where China’s advantages and international advantages converge,” Financial Secretary Paul Chan Mo-po said at an investor symposium held by the Milken Institute on Tuesday. Hong Kong is “the best place” for connecting business opportunities and businesspeople, he added.

The city will further enhance the share listing regime, mutual market access arrangements with the mainland, and the offshore yuan business to attract more investors, Chan said, emphasising its role as a “connector” between China and the world.

China this month set a growth target of around 5 per cent this year, similar to the pace last year, as growth adjusted to challenges including a prolonged slump in the housing market and currency depreciation. Geopolitical tensions and tech sanctions by Western countries have also hobbled exports.

More than 550 global executives, including UBS CEO Sergio Ermotti and BYD executive vice-president Stella Li, are attending the two-day event in Hong Kong to discuss current and future trends shaping the world’s economy.

“We have the advantage of being an international financial centre,” Clara Chan, CEO of HKIC, said at the symposium. “We have a robust, vibrant and open economy. “These are very important components to shape the next China narrative.”

China’s economic transition will not be easy as the nation moves from its dependency on the real estate sector, according to Ermotti. Ongoing geopolitical tensions are likely to create “volatility in macroeconomic developments” affecting not only China but also Asia, he added.

However, investors should take a long-term view while minimising the impacts of the near-term headwinds, Ermotti said, as China is still at the forefront of innovation in many major industries.

Fred Hu, founder and chairman of private equity firm Primavera Capital, is cautiously optimistic about China’s economic outlook. While a myriad of challenges is holding back a stronger Chinese economic expansion, investors should not forget its underlying strengths which are “very, very powerful”, he added.

The private sectors in China are lying low, but not out of the games, Hu said, adding that manufacturing innovation, productivity growth and household balance sheets remain strong.

“There’s still a lot that the government can do such as monetary policy to revive inflation and stop deflation, and there is also room for more fiscal policy [boost],” Hu added. “The government should really lift up consumer and business confidence. If domestic confidence returns, the Chinese economy will be roaring back.”

The news is published by EMEA Tribune & SCMP Follow our WhatsApp verified Channel

Follow our WhatsApp verified Channel