It is decidedly not a good look for U.S. stocks. Rallying at the open but finishing lower on the day sends a bad message about market health.

Most Read from MarketWatch

Doing it for a fourth session in a row, as the S&P 500 did on Thursday — the longest such streak of reversals in six years — suggests the recent rally is looking very sick indeed.

The only positive take from Friday’s early risk-off stock index futures action following Israel’s retaliatory drone strike on Iran is that it looks like the S&P 500 will start in the red.

Still, the mood is clearly sour. The S&P 500 has lost 4.63% since hitting its record close of 5,254.35 on March 28, while the tech-heavy Nasdaq Composite has shed 5.11% over just the last five sessions, its largest five-day percentage decline since December 2022.

What traders need to help them feel more chipper is some good old bullish optimism. And for that we can usually turn to Fundstrat’s head of research Tom Lee, who, to be fair, has been proved correct about the market’s surge to record highs this year.

Lee recognizes that action over the past two week or so has been dour, with the bleeding “part of a painful de-leveraging process” caused by growing disappointment around sticky U.S. inflation — which has pushed Treasury yields to five-month highs — as well as by geopolitical risks.

He provided this as pictorial metaphor.

But Lee sees five reasons why the de-leveraging by investors might be closer to ending.

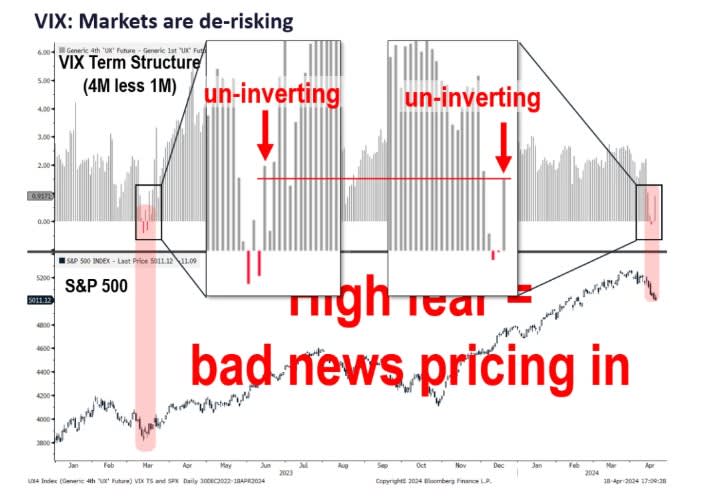

First, the VIX index is relatively subdued. The option-derived measure of expected volatility, known as Wall Street’s fear gauge, was moving back below 18 (before Friday’s Israel/Iran news pushed it higher), a sign than fretting is not gathering speed. The VIX’s level below it’s long-term average of 20 comes as Treasury yields ease back from the year’s highs.

Second, the VIX futures structure is “uninverting”. To explain, the four month VIX future is usually priced higher than the one month VIX future because more volatility-making things can happen over the longer time period. But when traders become worried about the near term, then the one month future price can be higher and the VIX futures curve becomes inverted.

This inversion happened recently as stocks slid but is now being corrected. “The last time the VIX term structure (4M less 1M) inverted, then uninverted, was March 2023 and that represented a major low. The uninversion shows markets see lower probabilities of a major high volatility event in the near term,” says Lee.

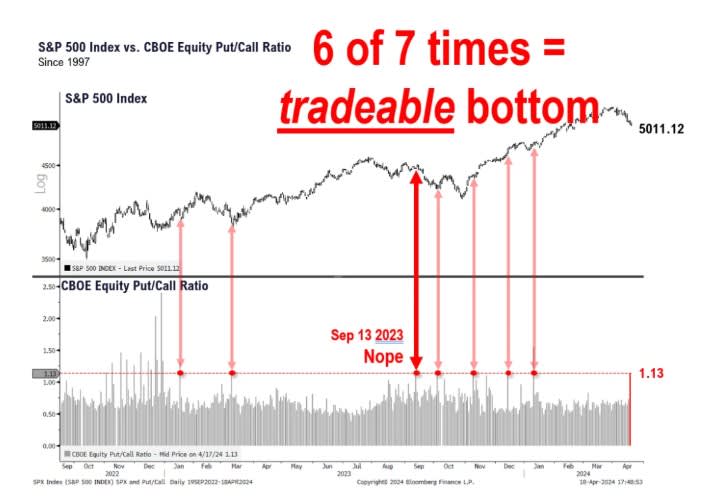

Third, the five-day declines for the S&P 500 have accelerated to a point where a rebound is likely. The five-day rate of change of minus 3.6% has been seen seven times since October 2022, Lee notes. Five of those seven times it signaled an immediate “tradeable low.” The other two occasions, in Feb. 2023 and Sep. 2023, there were further declines, but the “difference today is that the VIX terms structure is ‘un-inverting’.”

Next, the U.S. equity put to call ratio of 1.13 is high (meaning investors are buying more put options to protect against further stock declines than they are call options which are bets on a rise). Since October 2022, a ratio this high was six out of seven times a tradeable low.

Finally, Lee notes that Fundstrat’s technical druid Mark Newton has been reading the chart runes and he sees that various measures — such as the McClellan Oscillator, a breadth indicator that tracks the proportion of stock gainers and losers — have hit levels that suggest a low should be close.

Writing before Friday’s attack on Iran by Israel, Lee concedes that the biggest risk to equities and other cyclical assets is an escalating conflict between the two countries, particularly if it drags in others.

However, he concludes: “The fundamental case for stocks in 2024 remains intact, supported by strengthening earnings and the $6 trillion of cash on the sidelines.”

Markets

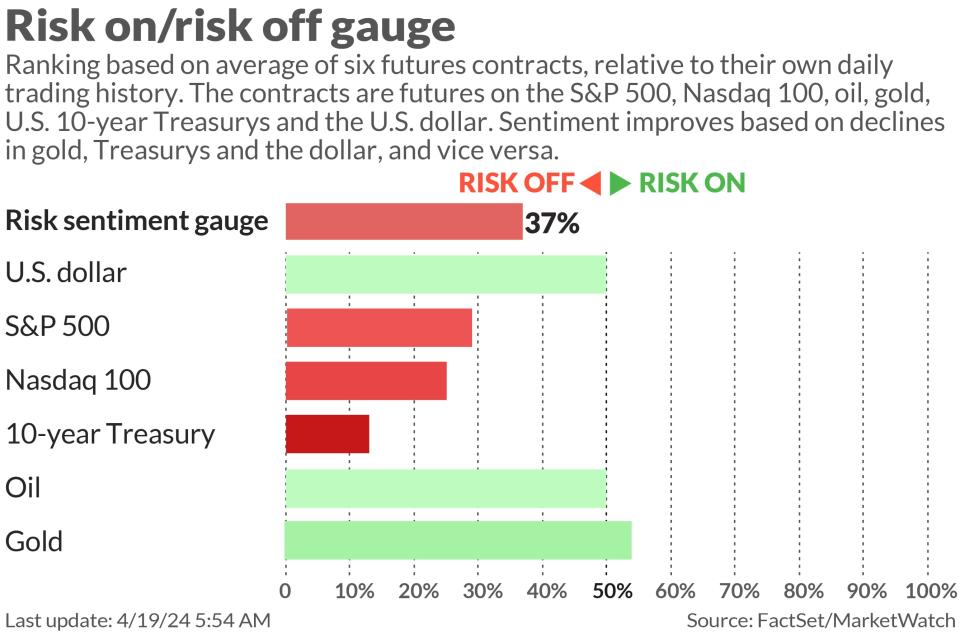

Israel’s attack on Iran produced a flurry of risk-off activity and flows into haven assets like the Swiss franc USDCHF, U.S. government bonds and gold. However, those moves have been pared back and now U.S. stock-index futures ES00 YM00 NQ00 are down but well off their session lows as benchmark Treasury yields BX:TMUBMUSD10Y slip just a few basis points. The dollar index DXY is a touch softer, while oil prices CL.1 climb and gold GC00 trades around $2,390 an ounce.

For more market updates plus actionable trade ideas for stocks, options and crypto, .

The buzz

There is no top drawer U.S. economic data due on Friday, but there is a touch of Fedspeak, with Chicago Fed President Austan Goolsbee making comments at 10:30 a.m. Eastern.

Netflix NFLX shares are shedding 6% in premarket action after the streaming group delivered better than expected results but said it would stop providing quarterly subscriber data.

Shares of Paramount Global PARA are up 7.5% following a report that Sony’s movie studio division is in talks with Apollo Global Management about joining a bid for Paramount.

Tesla’s stock TSLA, down 1.5%, is heading for a sixth straight slide as a Cybertruck recall is announced.

Procter & Gamble PG shares are down 1.5% after after the consumer packaged-goods company reported fiscal third-quarter sales that came up short of forecasts.

The world’s biggest election got underway as one billion Indians started to vote, with Narendra Modi favored to clinch a third term as prime minister.

Best of the web

Too many passive Investors? There’s no such thing.

They bet against the dollar. Now they’re paying the price.

The chart

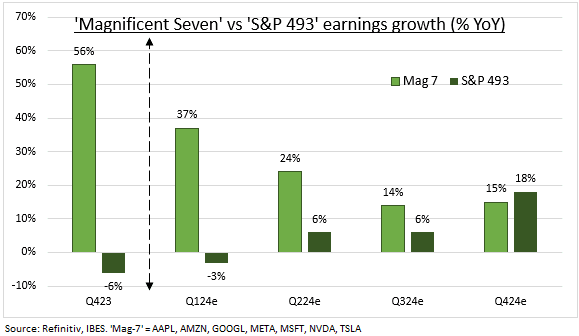

The Magnificent Seven are still doing the earnings heavy lifting, notes Ben Laidler, global market strategist at eToro. Five of the seven — the grouping comprises Amazon, Apple, Google parent Alphabet, Facebook parent Meta, Nvidia and Tesla — report quarterly results next week, “and they are key to another needed earnings surprise, making up 29% of S&P 500 market cap and estimated to grow earnings 37% vs the 3% fall for the other S&P 493,” says Laidlaw.

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

Ticker | Security name |

TSLA | Tesla |

NVDA | Nvidia |

NFLX | Netflix |

INFY | Infosys |

TSM | Taiwan Semiconductor Manufacturing |

DJT | Trump Media & Technology |

GME | GameStop |

AAPL | Apple |

AMC | AMC Entertainment |

NIO | Nio |

Random reads

Perhaps now would be a good time to remind Boston Dynamics about Asimov’s First Law.

Check out On Watch by MarketWatch, a weekly podcast about the financial news we’re all watching – and how that’s affecting the economy and your wallet. MarketWatch’s Jeremy Owens trains his eye on what’s driving markets and offers insights that will help you make more informed money decisions. Subscribe on Spotify and Apple.

Most Read from MarketWatch

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel