Plug Power (NASDAQ: PLUG) believes its focus on building a leading hydrogen network will lead to robust growth over the next few years. The company estimates it can grow its revenue from $1.2 billion last year to $20 billion by 2030, a 50% compound annual rate.

However, its troubling financial picture could stunt its growth. Because of that, investors should forget about investing in Plug Power and consider Brookfield Renewable (NYSE: BEPC)(NYSE: BEP) and NextEra Energy (NYSE: NEE) instead. While they don’t focus solely on hydrogen, they’re in excellent positions to capitalize on the fuel’s growth.

The knock against Plug Power

Plug Power is investing heavily in building its hydrogen network to increase its scale and reduce costs. The concern is that the company doesn’t have the financial capacity to spend at its current level.

That led the company to issue a dire warning last fall. Plug stated that it “is projecting that its existing cash and available-for-sale and equity securities will not be sufficient to fund its operations through the next 12 months.”

On a positive note, things have improved since that time. It has launched a stock offering to raise cash, and it’s working on finalizing a loan with the Department of Energy.

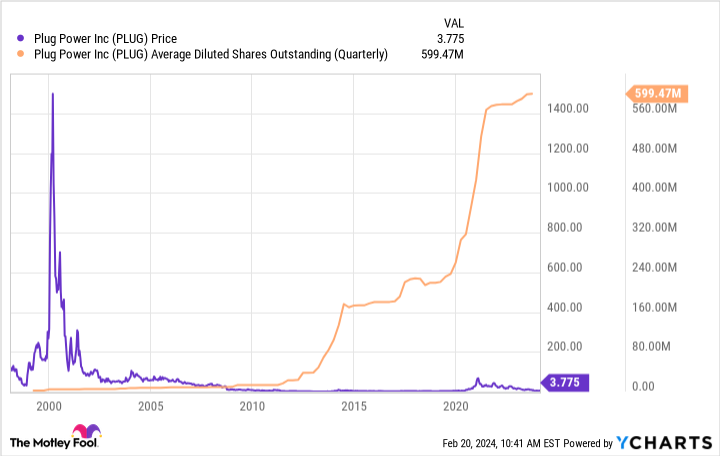

However, the company is far from having a sustainable financial foundation. Because of that, it might need to delay projects if it runs into additional financial trouble. Furthermore, the company’s stock sales could significantly dilute existing investors. That could add more weight to its sinking stock price:

As that chart shows, the meteoric rise in the number of its outstanding shares has put significant weight on its stock price.

On more sustainable foundations

Funding is an issue for Plug Power, but it’s not a problem for NextEra Energy or Brookfield Renewable. The leading renewable energy producers generate significant cash flow.

That gives them the money to help fund growth investments and return cash to investors through increasing dividends. They also both have strong balance sheets. On top of that, they routinely recycle capital by selling mature assets to fund higher-returning new investments. These features enhance their ability to grow value for shareholders.

Green hydrogen is one of the many growth opportunities they’re pursuing. NextEra Energy launched a pilot project to explore using green hydrogen to replace natural gas at one of its power plants. Meanwhile, Brookfield has partnered with several companies on green hydrogen projects, including Plug Power. It’s supplying renewable energy to power some of Plug’s projects.

Brookfield is also building a green hydrogen plant with Enbridge. The former will supply renewable energy to produce the emission-free fuel that the latter will inject into its natural gas distribution network.

Those projects are only the beginning. NextEra’s Real Zero goal includes replacing natural gas with green hydrogen at most of its existing gas-fired power plants over the next couple of decades. The company also plans to build renewable energy capacity to support third-party green hydrogen production.

It’s also evaluating building potential green hydrogen production plants. The company estimates that there’s a $4 trillion investment opportunity for renewable energy and green hydrogen in the U.S. to help decarbonize the economy by 2050.

Brookfield is also in an excellent position to capitalize on future green hydrogen investments. It recently agreed to provide $1 billion in funding to support Avaada Group’s green hydrogen and green ammonia ventures in India. The company also plans to use its recently launched Brookfield Global Transition Fund II to invest in green hydrogen to produce steel.

These investments in green hydrogen should enable Brookfield and NextEra Energy to continue growing their cash flows and dividends. NextEra recently extended its plan to increase its dividend by 10% annually through 2026, while Brookfield aims to increase its payout by 5% to 9% per year. Their growing earnings and dividends have helped give them the power to produce double-digit annualized total returns over the past decade, vastly outperforming Plug Power.

In a better position to cash in on the hydrogen megatrend

Plug Power doesn’t have the financial resources for its ambitious hydrogen growth plan, so that plan could stall if it runs out of funding.

That’s not an issue for Brookfield Renewable and NextEra Energy. They have plenty of power to cash in on the growth ahead for hydrogen. It could give them more fuel to grow their dividends and continue producing strong total returns for investors.

Should you invest $1,000 in Plug Power right now?

Before you buy stock in Plug Power, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Plug Power wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 20, 2024

Matt DiLallo has positions in Brookfield Renewable, Brookfield Renewable Partners, Enbridge, and NextEra Energy. The Motley Fool has positions in and recommends Brookfield Renewable, Enbridge, and NextEra Energy. The Motley Fool recommends Brookfield Renewable Partners. The Motley Fool has a disclosure policy.

Forget Plug Power, These Unstoppable Stocks Are Better Buys was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email [email protected] Follow our WhatsApp verified Channel