There was a time when tobacco stocks were among the best investments you could own. For example, Altria (NYSE: MO), which for much of its history also owned what is now Philip Morris (NYSE: PM), was the best-performing stock on the market over a nearly 50-year period, according to Wharton professor Jeremy Siegel.

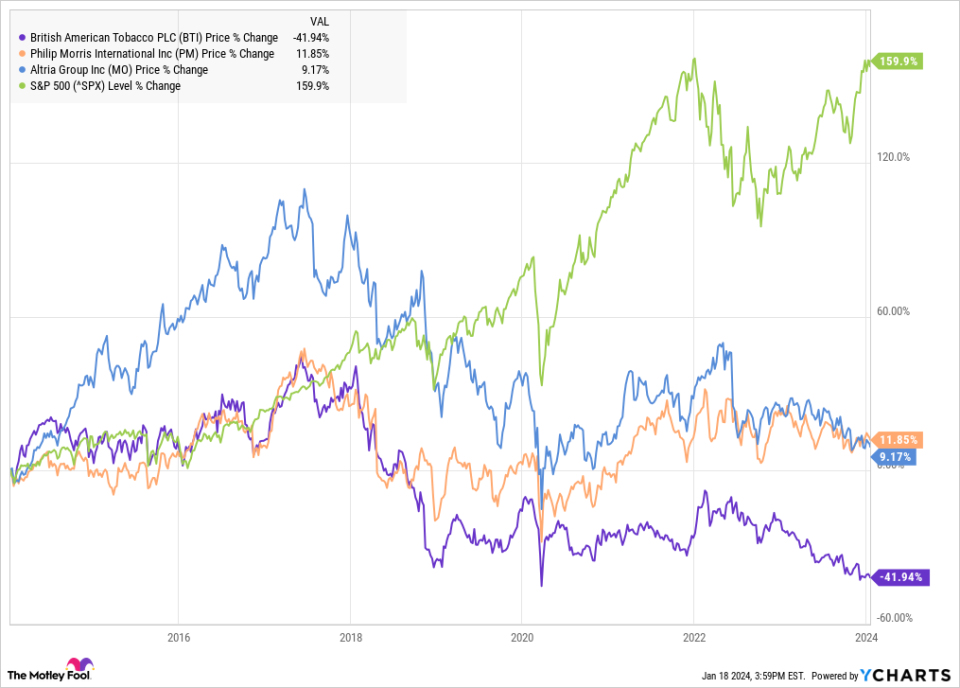

However, over the last decade, that’s changed. Shares of tobacco companies like those two and British American Tobacco (NYSE: BTI) have succumbed to pressure from declining cigarette sales, an inability to find a breakthrough next-gen product, and slowing growth in revenue and profits. As you can see from the chart below, British American Tobacco stock is down sharply over the last decade, and Philip Morris and Altria have only posted modest gains. Even on a total return basis, all three have underperformed the S&P 500.

Despite those headwinds, which have also included massive write-downs for things like Altria’s minority stake in JUUL and British American Tobacco’s U.S. cigarette portfolio, income investors still like the tobacco sector for its generous dividend yields.

At its current share price, British American Tobacco offers investors a dividend yield of 9.5%, making it one of the highest-yielding stocks on the market. However, a high yield alone doesn’t make a stock a buy, as the chart above helps illustrate. So is British American Tobacco a dividend stock worth buying, or is it a yield trap?

Where BAT stands today

British American Tobacco stunned investors last month by taking a $31 billion impairment charge, which the company said was consistent with its vision to “Build a Smokeless World” and the nature of the headwinds in the U.S. cigarette industry. It said the write-off was primarily related to its acquired U.S. combustibles brands, which include Camel, Newport, and other brands that came to BAT in its $49 billion purchase of Reynolds American in 2017.

That update also reflects the reality that demand for cigarettes continues to decline. British American Tobacco hasn’t delivered its full 2023 results yet, but the company said it expects to report 3% to 5% constant-currency revenue growth for the year, with tobacco sales volume falling by 3%. It also guided for adjusted earnings-per-share growth in the mid-single-digit percentages on a constant-currency basis.

Like peers Altria and Philip Morris, BAT has struggled to find a winner in the next-gen heated products category, and the company lost market share last year. Revenue from new categories was up 29% in the first half of the year to 1.66 billion pounds. Cigarette volume, meanwhile, was down 4.7% on an organic basis in the first half, and constant-currency revenue in the category was up 0.2% to 10.8 billion pounds.

Looking ahead, the company is guiding for low-single-digit revenue and adjusted operating profit growth in 2024, and is targeting an improvement to 3% to 5% revenue growth and mid-single-digit percentage adjusted operating profit growth.

Is British American Tobacco a buy?

British American Tobacco’s dividend is well funded, as the company had a dividend payout ratio of 76% based on cash flow and just 61% on an accounting basis. That should reassure investors that BAT can continue to fund its dividend even in a slow-growth environment.

However, in a best-case scenario based on the company’s guidance, British American Tobacco’s business is only expected to generate modest top- and bottom-line growth, and the risk for further challenges is clear, as there are still significant regulatory risks in new products and the potential for taxes and other restrictions to increase on cigarettes.

The stock is cheap and the dividend looks safe, but the upside potential of the stock is limited. Dividend investors looking solely for yield might want to consider BAT, but there are still a lot of risks in the tobacco sector that can lead to share price depreciation in the coming years.

Should you invest $1,000 in British American Tobacco P.l.c. right now?

Before you buy stock in British American Tobacco P.l.c., consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and British American Tobacco P.l.c. wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 16, 2024

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool recommends British American Tobacco P.l.c. and Philip Morris International and recommends the following options: long January 2024 $40 calls on British American Tobacco P.l.c., long January 2026 $40 calls on British American Tobacco P.l.c., and short January 2026 $40 puts on British American Tobacco P.l.c. The Motley Fool has a disclosure policy.

Is British American Tobacco’s 9.5% Dividend Yield Too Good to Be True? was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email [email protected] Follow our WhatsApp verified Channel