When it comes to artificial intelligence (AI), the “Magnificent Seven” stocks — Apple, Microsoft, Amazon, Alphabet, Nvidia, Meta Platforms, and Tesla — always seem to find their names in the headlines.

Among this small group, perhaps Nvidia is the most closely followed. The company manufactures high-end semiconductor chips called graphics processing units (GPUs). GPUs are used in a variety of generative AI applications, including the training of large language models and machine learning.

One of Nvidia’s closest allies is a much smaller company called Super Micro Computer (NASDAQ: SMCI). While Nvidia creates the technology powering semiconductors, Super Micro Computer plays an integral role behind the scenes related to how these chips fit into IT architecture such as server racks and storage clusters.

Investors have taken note of Super Micro’s important role within the artificial intelligence (AI) landscape and have eagerly bought up the stock. Over the last year, shares of Super Micro are up almost 800%. Given such a magical run, some investors may be thinking it’s too late to invest in this “stealth Nvidia” business.

Let’s dig into Super Micro’s operation and understand why the stock has enjoyed so much investor enthusiasm. More importantly, by taking a look at the long-term outlook, investors may come to understand that Super Micro’s run could just be getting started.

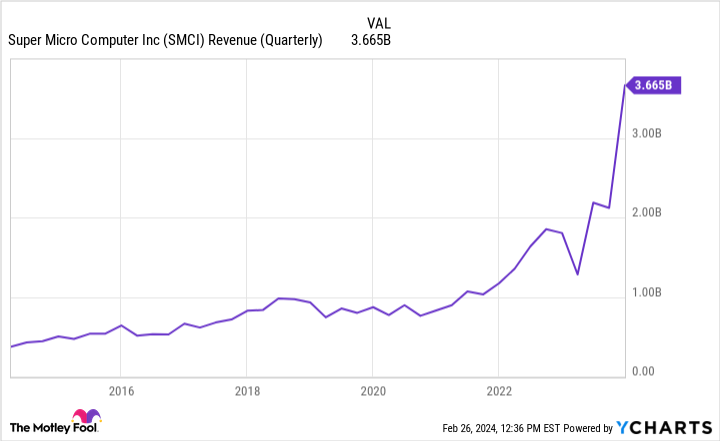

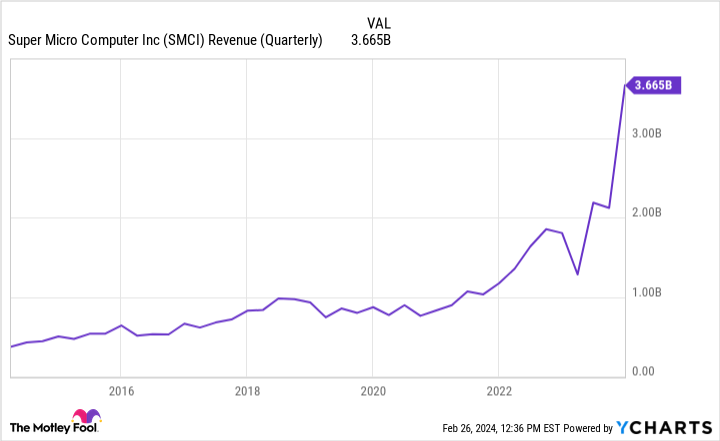

Sales are soaring, but there’s more to the picture

The chart below makes one thing overwhelmingly obvious: Super Micro’s revenue is off the charts (almost literally!). One of the clearest indicators of this revenue growth is the company’s strong ties to Nvidia. Since demand for Nvidia’s GPUs is high, the need for Super Micro’s IT architecture designs is more important than ever.

While it is easy to become enamored by Super Micro’s potential, there is much more to the picture than just robust sales growth. The company is actually a low-margin business. For the second quarter of its fiscal 2024, ended Dec. 31, 2023, Super Micro reported a gross margin of 15.4%. By comparison, its gross margin was 18.7% in the same period last year.

Management attributed the margin deterioration to hefty investments in growth. More specifically, as GPUs become more sophisticated, optimal design architecture also becomes increasingly complex — this is a costly undertaking as Super Micro is firing on all cylinders to acquire more market share.

I understand the need to invest today to achieve sustained growth in the long run. However, if demand for AI chips begins to wane, Super Micro’s profitability profile could experience a more pronounced dip.

What goes up, must come down

Following its blowout earnings report in January, Super Micro shares continued to soar. While shares are up over 200% so far in 2024, trading activity has actually started to cool down after briefly eclipsing $1,000 per share earlier this month.

I see a couple of items at play here. First, nearly all of the megacap tech companies have reported earnings at this point. Investors now have a lot of data points to digest and sift through. It’s going to take some time to assess which companies are best positioned to continue riding the AI wave. And there could be some problems for Super Micro specifically.

For starters, Nvidia recently shed some light on its supply chain woes — a problem it’s had for quite some time. There’s a risk that this problem could have a domino effect on Super Micro.

Another one of Super Micro’s strong relationships is with Nvidia’s top rival, Advanced Micro Devices. After it reported mixed earnings earlier this year, some investors have legitimate concerns about AMD’s long-term growth prospects. Again, should demand for AI chips plateau, both Nvidia and AMD will suffer, and that will affect Super Micro.

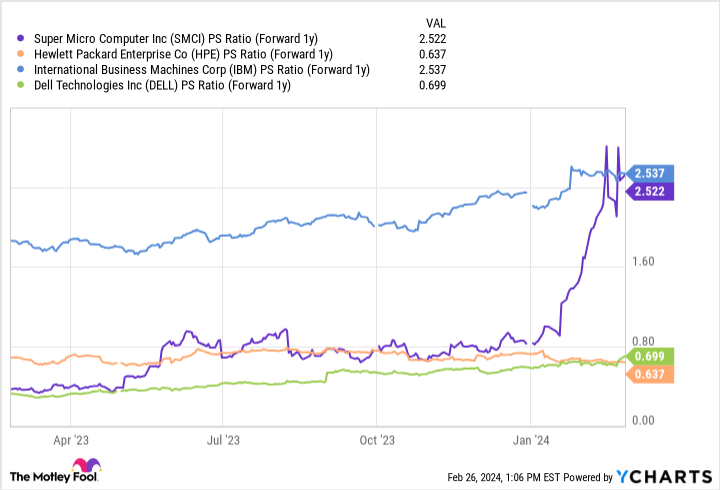

The valuation is tough to decipher

The chart above illustrates the forward price-to-sales (P/S) ratio of Super Micro Computer against a cohort of other IT architecture designers. At a forward P/S of 2.5, Super Micro is valued in line with International Business Machines. This is peculiar because IBM is a much larger, more prolific business that sells software and consulting services in addition to hardware.

Wall Street’s expectations for Super Micro vary greatly. The consensus price target of $652 implies that Super Micro stock is currently overvalued — and considerably so. However, Hans Mosesmann of Rosenblatt Securities is calling for 48% upside from current levels and has a Street-high price target of $1,300.

I think Super Micro still has a lot of room to run, but I would also not be surprised to see a pullback in demand at some point. For this reason, I’d be cautious about scooping up shares in Super Micro right now.

It could represent a hedge to other AI stocks in your portfolio, and I see the company as a winner in the long run. However, valuation is a legitimate concern, and buying into momentum stocks can come with a lot of risk. The most prudent thing to do right now may be to assess the company’s ongoing earnings reports and keep a close eye on other businesses involved in the AI chip market as well.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 26, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends Super Micro Computer and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Is It Too Late to Buy Super Micro Computer Stock Now? was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email [email protected] Follow our WhatsApp verified Channel