ExxonMobil (NYSE: XOM) is a great oil company. It has delivered peer-leading growth across several key metrics over the past several years. It also has the longest dividend-growth streak in the oil patch at 41 consecutive years.

However, ExxonMobil might not be the best energy stock for all investors. Chevron (NYSE: CVX), Enterprise Products Partners (NYSE: EPD), and Enbridge (NYSE: ENB) stand out to a few Fool.com contributors as potentially better investment opportunities. Here’s why investors looking at ExxonMobil should also consider these energy stocks.

Chevron has a higher yield and lower leverage

Reuben Gregg Brewer (Chevron): ExxonMobil, with a market cap of nearly $420 billion, is a much larger company than Chevron, which has a market cap a touch below $280 billion. So if you want the 800-pound gorilla in the energy sector you should buy ExxonMobil. But after that one data point, ExxonMobil and Chevron are very similar integrated energy companies. Chevron, meanwhile, has a couple of key stats that might tip the scale in its direction.

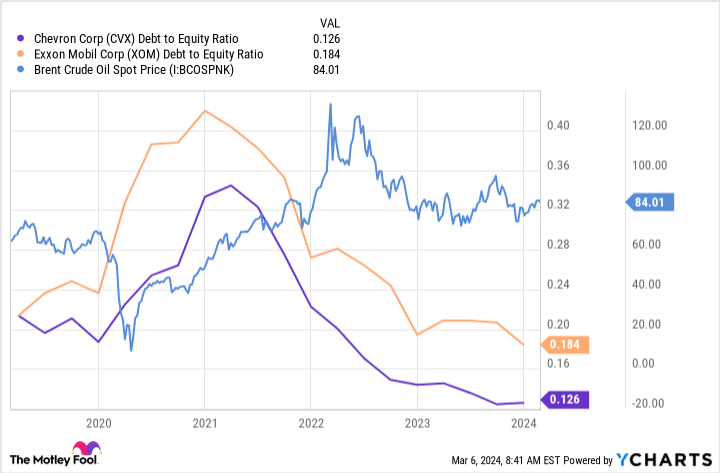

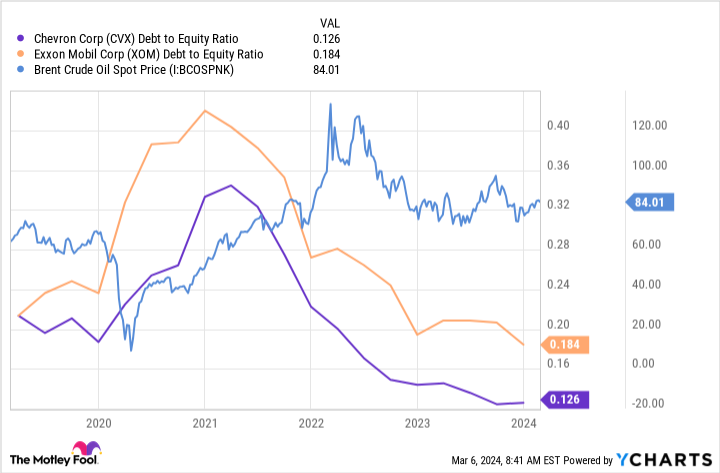

First off, Chevron’s debt-to-equity ratio is 0.12 times versus ExxonMobil’s 0.18 times. Chevron’s lower leverage is a trend that has been in place for a number of years at this point but winds up being important because of the cyclical nature of the oil patch. When oil prices fall, Chevron and ExxonMobil both lean on their balance sheets to support their businesses and continue to pay their dividend. Chevron simply has more leeway on that front today.

And then there’s the dividend. Yes, ExxonMobil’s 41-year streak of annual increases is better than the 36 years Chevron has put up, but both are still impressive shows of dividend commitment. They really stand toe-to-toe on this factor. But Chevron’s dividend yield is 4.3% today compared to ExxonMobil’s 3.6%. That makes Chevron a much more attractive dividend stock.

If you are looking at ExxonMobil, Chevron is very similar and, perhaps, even better in two very important ways.

A much bigger yield than ExxonMobil

Neha Chamaria (Enterprise Products Partners): Investors in energy often flock to ExxonMobil for two reasons: the oil giant’s rock-solid dividend-growth streak, backed by steady cash flows and strong financials. After all, 41 years of consecutive annual dividend increases in a cyclical sector like energy is no joke.

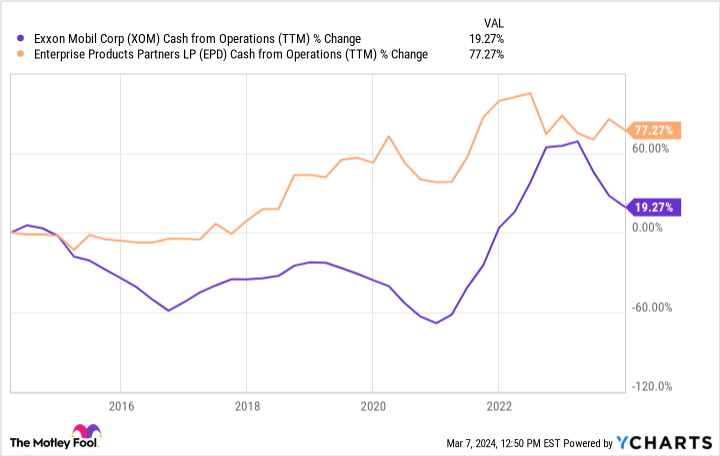

Yet, while there’s no denying that ExxonMobil has proven its mettle, there’s another energy stock that looks promising for long-term investors: Enterprise Products Partners. Enterprise Products may not have a long dividend-growth track record like ExxonMobil, but it has raised its dividends every year for the past 25 consecutive years nonetheless, and the dividend yield is a solid 7.2%, or twice ExxonMobil’s yield.

Importantly, its high yield is well-supported by cash flows, making Enterprise Products’ dividends reliable. In 2023, for example, Enterprise Products generated enough distributable cash flows (DCF) to cover its dividends by 1.7 times. In fact, its DCF has consistently remained above 1.5 times since 2018. Operating in the midstream oil and gas space helps as Enterprise Products’ cash flows tend to be more stable than ExxonMobil’s given the largely contractual nature of its services.

As for its financial fortitude, Enterprise Products has manageable debt and ample liquidity, and it boasts one of the highest credit ratings in the midstream energy space.

Like ExxonMobil, Enterprise Products has proven its mettle over the years, and with management committed to dividend growth while expanding the company’s infrastructure, an investment in Enterprise Products stock should pay off in the long run.

A much, much lower-risk energy stock

Matt DiLallo (Enbridge): As an oil and gas producer, ExxonMobil is a price taker. It must sell its output at the going market rate, which could be high or low depending on market conditions. Because of that, its earnings can be very volatile. For example, while ExxonMobil earned $36 billion last year, that was about $20 billion less than it hauled in during 2022 when oil and gas prices were much higher.

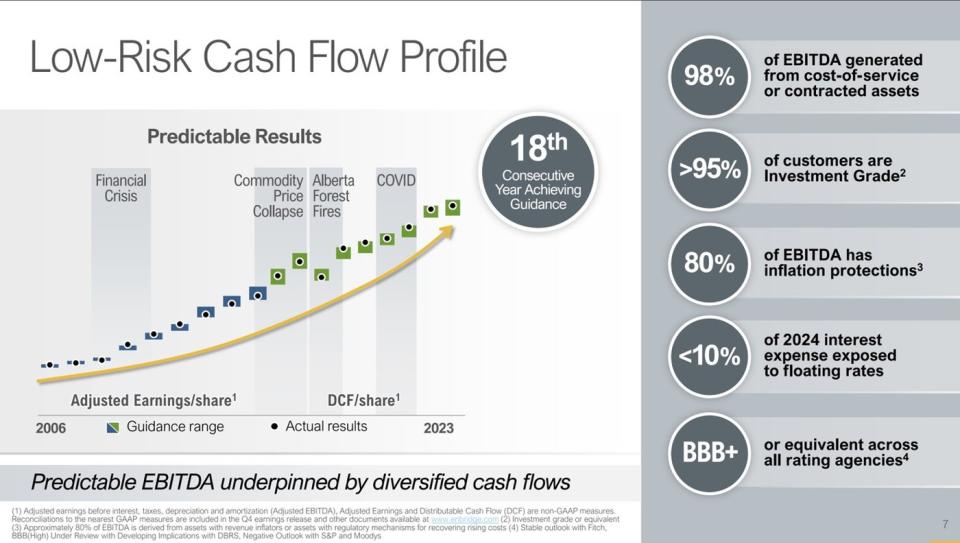

Commodity prices don’t matter much to Enbridge. The Canadian pipeline and utility company gets 98% of its earnings from stable, predictable cost-of-service arrangements and long-term contracts. It gets paid the same rate no matter the price of the oil and gas flowing through its massive pipeline systems. Enbridge also generates predictable earnings from operating natural gas utilities and renewable energy assets. Because of that, its cash flow has steadily grown (and achieved the company’s annual guidance) despite significant market dislocations over the years:

Enbridge’s business model also gives it much more visibility into its earnings growth. The company expects its adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) to rise by 7% to 9% annually through 2026 and grow at around a 5% annual rate after that. The company’s stable revenue frameworks and growing backlog of expansion projects give it lots of visibility into future earnings growth.

They also drive Enbridge’s view that it can continue increasing its 7.7%-yielding dividend, which it has raised for 29 straight years. That higher yield, along with its more predictable business model, makes Enbridge a much lower-risk way to invest in energy stocks.

Should you invest $1,000 in ExxonMobil right now?

Before you buy stock in ExxonMobil, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ExxonMobil wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 8, 2024

Matt DiLallo has positions in Chevron, Enbridge, and Enterprise Products Partners. Neha Chamaria has no position in any of the stocks mentioned. Reuben Gregg Brewer has positions in Enbridge. The Motley Fool has positions in and recommends Chevron and Enbridge. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

Looking at ExxonMobil? Consider These 3 Energy Stocks Instead was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email [email protected] Follow our WhatsApp verified Channel