Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) had more than $110 billion in cash and cash equivalents on its balance sheet at the end of 2023. The company is investing heavily in artificial intelligence, and capital expenditures are projected to climb 27% this year from a record $32 billion last year, according to Bloomberg.

However, several Wall Street analysts saw that cash pile as evidence that Alphabet was preparing to pay a dividend. Lo and behold, when the company reported first-quarter earnings results last week, management announced a dividend of $0.20 per share payable on June 17 to stockholders of record on June 10.

That makes Alphabet the newest dividend stock in the Nasdaq 100, an index that tracks the 100 largest companies on the Nasdaq Stock Exchange. But investors shouldn’t interpret that news to mean Alphabet lacks growth prospects. On the contrary, its market capitalization could reach $4 trillion by 2030, implying 90% upside.

Here’s what investors should know.

Alphabet looked strong in the first quarter

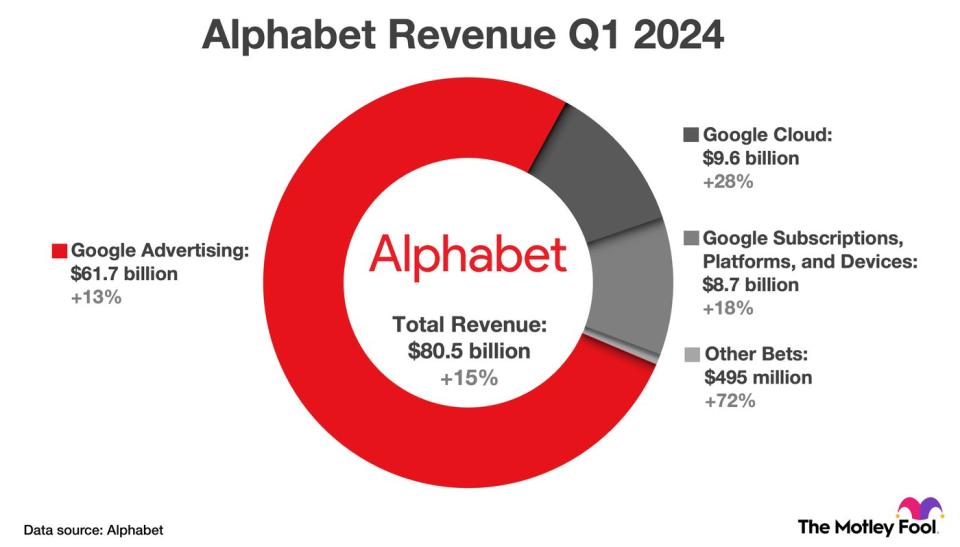

Alphabet reported stellar financial results in the first quarter, easily surpassing what Wall Street expected on the top and bottom lines. Revenue increased 15% to $80.5 billion due to particularly strong momentum in Google Cloud, the product category that includes cloud infrastructure and platform services, and the business productivity suite called Google Workspace.

Alphabet has been optimizing its cost base by focusing on the most compelling product development opportunities and rightsizing its workforce. That strategy continued to bear fruit in the first quarter. Operating margin expanded 700 basis points (7 percentage points) and GAAP net income jumped 62% to $1.89 per diluted share.

The chart below provides more detail on first-quarter revenue growth across Alphabet’s four primary product categories.

Going forward, management sees substantial growth opportunities in search advertising and cloud computing, especially where artificial intelligence (AI) is concerned. CEO Sundar Pichai said, “Our leadership in AI research and infrastructure, and our global product footprint, position us well for the next wave of AI innovation.”

Regarding its footprint, Alphabet has six products that serve more than 2 billion monthly users — think Google Search, YouTube, Chrome, and Android. That gives the company deep insight into consumer tastes and preferences, and that data informs its machine learning models to improve campaign outcomes for media buyers. Additionally, Alphabet’s newest generative AI model, Gemini, lets advertisers build campaigns and create relevant media assets (images and text) with natural language prompts.

Beyond advertising, Alphabet’s Gemini model lets developers build generative AI applications in Google Cloud, and it automates tasks across Google Workspace applications. For instance, Gemini can draft text in Google Docs, create media content in Google Slides, and organize data in Google Sheets.

Alphabet has growth opportunities in digital advertising and cloud computing

Alphabet has two significant growth engines in digital advertising and cloud computing. The company is expected to lose share across the broader advertising market in the coming years, but it will still account for roughly 27% of digital ad spending in 2025, about 490 basis points more than its nearest competitor Meta Platforms, according to eMarketer.

In particular, Alphabet remains well positioned in search and video advertising. Google dominates internet search with more than 91% market share, and YouTube is the most popular streaming service as measured by viewing time. Notably, some investors have expressed concern that generative AI could erode Google’s search dominance, but Alphabet is leaning into that trend with Search Generative Experience (SGE).

SGE applies generative AI to Google Search to help users understand topics more quickly and deeply, while prioritizing traffic to websites and merchants. Pichai provided an update on the latest earnings call. “We are seeing an increase in Search usage among people who use the new AI overviews, as well as increased user satisfaction with the results,” he said.

In cloud computing, Alphabet’s Google Cloud Platform (GCP) is not as large as Amazon Web Services, nor is it gaining market share as quickly as Microsoft Azure. However, GCP has gained ground in recent years. It accounted for 11% of cloud infrastructure and platform services spending in the fourth quarter of 2023, up 1 point from 2021 and 3 points from 2019.

Going forward, GCP could continue to gain market share in the cloud as Gemini and other AI products see greater adoption. Indeed, Pichai alluded to that possibility during the latest earnings call. “We have the best infrastructure for the AI era,” he said. “More than 60% of funded generative AI start-ups and nearly 90% of generative AI unicorns are Google Cloud customers.”

Why Alphabet could be a $4 trillion company by 2030

Wall Street expects Alphabet to grow revenue at 10.5% annually over the next five years. I think that leaves room for upside, especially if Alphabet continues to gain market share in cloud computing. I say that because the online advertising and cloud computing market are projected to expand at 16% annually and 14% annually, respectively, through 2030.

That gives Alphabet a reasonable shot at sales growth of 12% annually through the end of the decade. At that pace, trailing-12-month revenue would reach $628 billion in six years, such that the company would have a market capitalization of $4 trillion if shares traded at 6.4 times sales. That would be a discount to the current valuation of 7.2 times sales, and it would roughly align with the three-year average of 6.3 times sales.

If Alphabet’s market capitalization does reach $4 trillion in six years, that would mean 90% upside for investors, which works out to an annual return of 11.3%. That makes this Magnificent Seven stock a compelling long-term investment idea.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $537,557!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 22, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Trevor Jennewine has positions in Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Meet the Newest Dividend Stock in the Nasdaq 100. It Could Be a $4 Trillion Company by 2030, With Help From Artificial Intelligence. was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel