The race to develop infrastructure for powering generative artificial intelligence (AI) applications intensified following reports that Microsoft (NASDAQ: MSFT) and OpenAI are expected to invest $100 billion to $115 billion in a new supercomputer called Stargate, according to tech-focused business publication The Information.

While Microsoft and OpenAI themselves haven’t released any details, the two companies are reportedly in the third phase of a five-phase project, of which Stargate is to be the fifth phase. The article suggests that a significant chunk of the budget for the project is likely to be spent on semiconductors, and the goal is for the supercomputer to go online in 2028.

To put things in perspective, Stargate could be 100 times more expensive than what it costs to build a massive data center right now, and the projected outlay on the project would be more than triple Microsoft’s capital spending last year. There is a solid way for investors to capitalize on this potentially massive AI investment from Microsoft — Arm Holdings (NASDAQ: ARM).

Microsoft’s deployment of custom chips based on Arm’s designs could give the latter a boost

Arm Holdings is a British chip designer that licenses its intellectual property to semiconductor companies and original equipment manufacturers, which then customize Arm’s instruction sets to manufacture chips to their specifications and requirements. Its IP is used for manufacturing central processing units (CPUs), graphics processing units (GPUs), neural processing units (NPUs), and interconnect technologies.

According to Arm, more than 70% of the global population uses products based on its intellectual property. That’s not surprising: Almost all the smartphones in the world run on Arm-based processors, while 50% of CPUs are made using its instruction sets. The company has two sources of revenue: licensing and royalties. It receives licensing fees from customers after selling its intellectual property to them. Customers also pay Arm royalties for every chip they ship that contains its technology.

Microsoft’s new endeavor could be a tailwind for Arm’s business. In November, Microsoft introduced its first in-house custom AI CPU, the Azure Cobalt. This custom CPU is based on the Arm Neoverse CSS platform. Arm says that Cobalt can “tackle the biggest and most complex challenges the infrastructure will face from AI to sustainability.”

Tech sector news site The Next Platform predicts that Microsoft will be looking to reduce its reliance on the likes of Nvidia by deploying future generations of the Cobalt processor for Stargate. That wouldn’t be surprising, as custom AI processors not only save cloud companies money on capital costs and electricity expenses but also deliver better performance. Microsoft, for instance, said it witnessed jumps in performance of up to 40% after deploying the first generation of Cobalt chips.

Considering the huge amount of power that a supercomputer the size of Stargate would need, Microsoft is likely to pack a considerable amount of power-efficient custom chips such as Cobalt into it instead of power-hungry GPUs. As a result, Arm’s AI-related revenue is likely to get a shot in the arm as Microsoft builds its ambitious supercomputer.

The stock is already primed to deliver solid gains

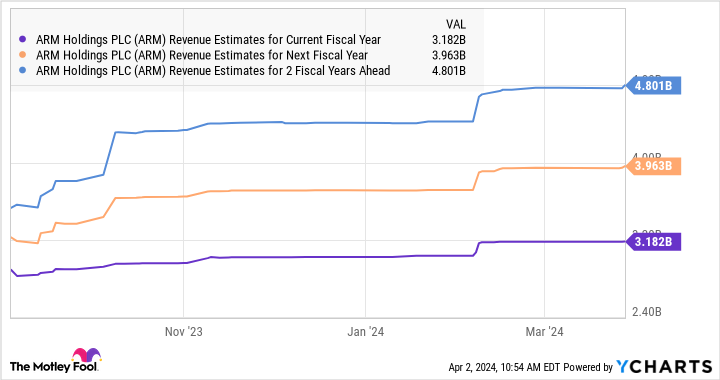

The good part is that Arm is already benefiting from the growing adoption of AI chips, but Microsoft’s big project could provide yet another catalyst that leads to stronger top-line growth than analysts are anticipating.

The current consensus estimates are for Arm’s earnings to increase at an annualized rate of nearly 45% for the next five years. If that proves accurate, its bottom line will jump to about $7.63 per share after five years (using its fiscal 2024 projected earnings of $1.19 per share as the base). If we multiply that projected earnings figure with the Nasdaq-100‘s forward earnings multiple of 27.3 (using the index as a proxy for tech stocks), we get a projected stock price for Arm of $208 in five years — 69% above current levels.

However, its earnings could be even stronger on the back of Stargate-driven demand from Microsoft, which is why investors looking to buy an AI stock would do well to buy Arm before it surges higher.

Should you invest $1,000 in Arm Holdings right now?

Before you buy stock in Arm Holdings, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Arm Holdings wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 1, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Microsoft’s $100 Billion Generative Artificial Intelligence (AI) Splurge Could Send This Stock Soaring was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel