For all the recent fretting about sticky inflation and interest rates staying high for longer, the S&P 500 sits just 1% shy of its record closing peak, and the Nasdaq Composite COMP on Thursday registered its sixth record of 2024, helped by a resurgent Apple AAPL.

Most Read from MarketWatch

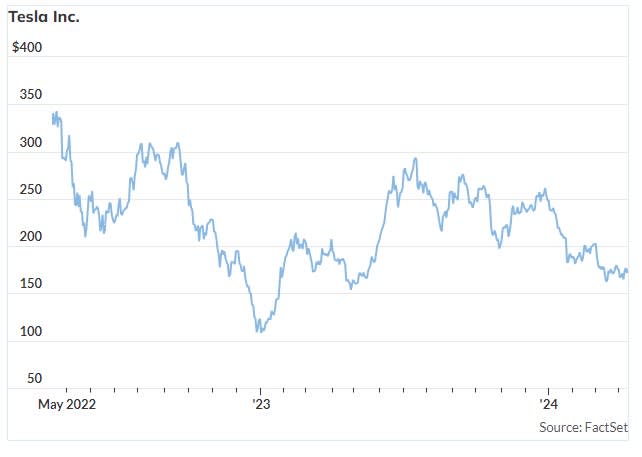

Also, supporting the tech barometer of late are shares of Tesla TSLA, which has risen 6% this week after fans bought a stock that was flirting with its lowest price in 12 months, having dropped by about a third this year.

The good news for owners of Tesla stock is that long-term bull Dan Ives, analyst at Wedbush, has a 12-month price target of $300, which closed Thursday just shy of $175.

The bad news is the target’s been going in the wrong direction. It was recently $350 and then $315 after Ives described Tesla’s last earnings call a “train wreck” and the latest car sales figures fell 9% over the previous year.

And judging by Ives’s latest note there looks to be a fair chance he might trim his Tesla share price target further if founder and CEO Elon Musk doesn’t convey adequately to investors at the April 23 conference call discussing first-quarter earnings how the EV carmaker can return to growth.

In particular, to navigate what Ives calls a “Category 5 demand storm”, Musk must prioritize delivering a cheaper car along with the robotaxis that the entrepreneur said he would unveil on Aug. 8.

“A key part of the future growth story for Tesla is the Model 2 vehicle and sub $30k price point to drive mass demand globally in this EV landscape,” says Ives in a new note Thursday. “We estimate that around 60% of future growth the next few years will come from Model 2 which was set to hit the roads by late 2025 or early 2026.”

If Musk indicates that robotaxis are the “magic model” to replace the Model 2, Ives said it would be a “debacle negative” for the Tesla story.

With heightened competition in China and global EV demand softening, alongside Musk talking of developing AI outside of Tesla, and issues such as the spat with Delaware over his compensation, “patience is starting to wear very thin among investors,” says Ives.

Ives says Musk is facing “a fork in the road time” to navigate Tesla though this difficult period otherwise the situation will get worse.

“Musk will need to quickly take the reins back in to regain confidence in the eyes of the Street. It all starts with this upcoming conference call and laying out the growth strategy for Tesla in China (and globally) to reverse this negative demand trend,” says Ives.

The Wedbush analyst concludes by stressing he remains long term bullish but that the future of Tesla is a bit murky right now. “Musk needs to give the clear roadmap and strategic vision for the Street with Model 2 a key component,” Ives reiterates.

Markets

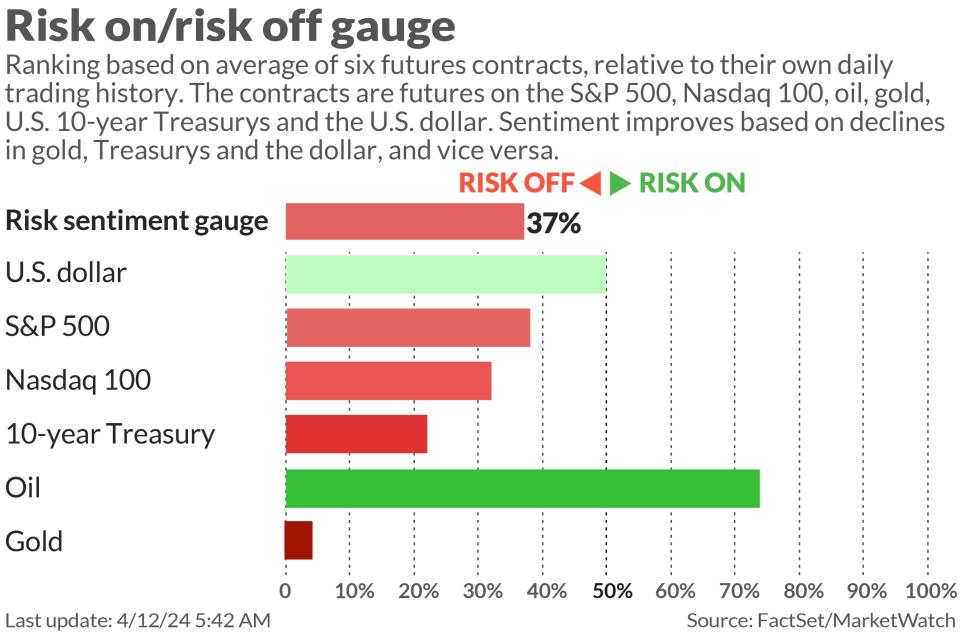

U.S. stock-index futures ES00 YM00 NQ00 are lower, with tech lagging, as benchmark Treasury yields BX:TMUBMUSD10Y fall back by several basis points. The dollar DXY is at a fresh four-month high, while oil prices CL.1 firm..

For more market updates plus actionable trade ideas for stocks, options and crypto, .

The buzz

U.S. economic data due on Friday include the import price index for March at 8:30 a.m. Eastern, followed at 10 a.m. by the preliminary reading of April consumer sentiment.

Fed officials making comments include Kansas City Fed President Jeffrey Schmid talking at 1 p.m. Atlanta Fed President Raphael Bostic speaking at 2:30 p.m. and San Francisco Fed President Mary Daly talking at 3:30 p.m.

The first quarter of 2024 corporate earnings season kicks into gear with large financials leading the way. So far results from JPMorgan Chase JPM, down 2.6% and Wells Fargo WFC, off 1%, having not been very well received, but Citigroup C is up 2% after revealing its numbers.

Apple AAPL is to launch a new line of Macs as part of its AI push, according to a report.

The price of gold GC00 hit a fresh record high near $2,400 an ounce amid concerns Iran may strike against Israeli targets in coming days.

The dollar hit a new 34-year high versus the yen USDJPY near 153.4, as traders played chicken with possible intervention by Japan’s Ministry of Finance.

Best of the web

Peloton is more like a media company now.

Interest rates have investors worried. Profits give them comfort.

Renewcell’s plan to fix fashion’s waste problem ended in bankruptcy.

The chart

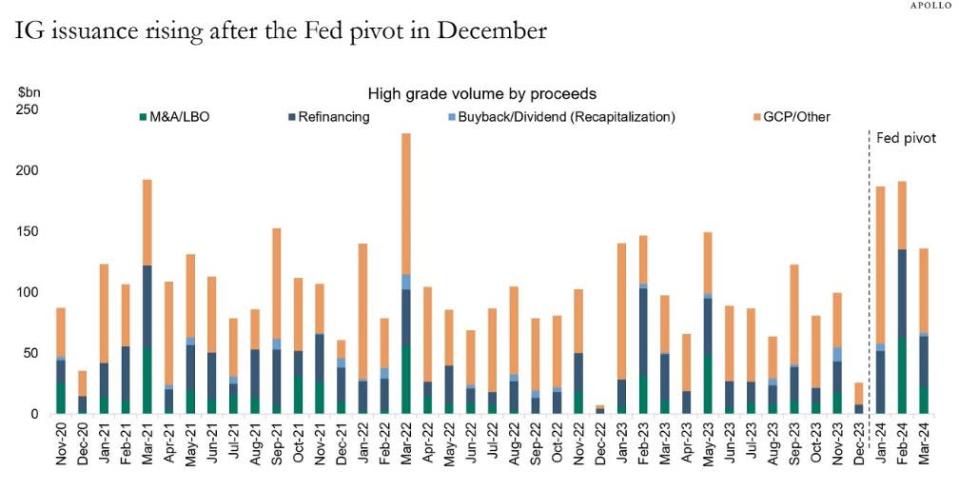

Capital market activity has increased significantly since the Fed meeting in December, notes Torsten Sløk, chief economist at Apollo Group, with more issuance in investment grade and high yield debt in January, February, and March.

“More M&A activity, more IPO activity, tighter credit spreads, and higher stock prices all contribute to stronger GDP growth and higher inflation over the coming quarters,” says Sløk.

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

|

Ticker |

Security name |

|

NVDA |

Nvidia |

|

TSLA |

Tesla |

|

AAPL |

Apple |

|

GME |

GameStop |

|

AMZN |

Amazon.com |

|

TSM |

Taiwan Semiconductor Manufacturing |

|

NIO |

Nio |

|

AMD |

Advanced Micro Devices |

|

DJT |

Trump Media & Technology |

|

AMC |

AMC Entertainment |

Random reads

$1,000 buys a slice of ‘Beer Can Island.’

Escaped racehorse joins commuters at train station.

Need to Know starts early and is updated until the opening bell, but to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Check out On Watch by MarketWatch, a weekly podcast about the financial news we’re all watching – and how that’s affecting the economy and your wallet. MarketWatch’s Jeremy Owens trains his eye on what’s driving markets and offers insights that will help you make more informed money decisions. Subscribe on Spotify and Apple.

Most Read from MarketWatch

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email [email protected] Follow our WhatsApp verified Channel