(Bloomberg) — Netflix Inc. investors have big expectations for the streaming giant’s first-quarter results due Thursday, which bulls hope will support a rally back toward record levels for the stock.

Most Read from Bloomberg

The shares have been on a tear in the past six months, adding $112 billion in value. Netflix is one of the top performers on the S&P 500 Index, rallying to within about 13% of its 2021 record high as growing earnings have driven down its valuation. It’s up 25% since its January report, where it flagged its best quarter of growth since the coronavirus pandemic.

The drivers behind that gain — a password crackdown and a new ad-supported subscription tier — are expected to continue into the first quarter of the year, with bullish investors hoping the results are the next catalyst for Netflix’s run. Wall Street expects this to be the firm’s strongest quarter yet in terms of adjusted earnings per share — the average analyst estimate is nearly 60% higher than the same period a year earlier.

“The bar is high and I think it’ll be high for a while,” said Rob Conzo, CEO and managing director of The Wealth Alliance. “It’s like a juggernaut, they just keep rolling along.”

Shares were down about 1% Thursday at 2 p.m. in New York.

After gaining more than 13 million new subscribers in the final quarter of 2023, Netflix is expected to have added another 4.8 million in the reporting period — an estimate that may even be on the low side, according to Bloomberg Intelligence analyst Geetha Ranganathan.

“Continued traction on the advertising tier, paid sharing efforts and a steadily improving content slate suggest that net adds may be closer to 6 million,” she wrote in a note. In comparison, the Paramount+ streaming service added 4.1 million subscribers in its fourth quarter.

At the height of Netflix’s pandemic boom, its stock traded at about 53 times forward earnings. That’s currently down to about 33 times forward earnings, according to Bloomberg data — albeit still at a premium to the tech-heavy Nasdaq 100 Index.

“When you have a product that just keeps delivering on its performance, it’s hard to argue it’s not worth it,” Conzo said.

Netflix Has Best Week Since 2022 on Stunning Subscriber Jump

To be sure, not all analysts are so bullish. Should Netflix not meet Wall Street’s expectations, its stock could be vulnerable to selling. And, while results have lifted it in recent quarters, the shares can be choppy around earnings, with an average move of 10% in either direction according to Bloomberg data.

“To continue to beat expectations that have already come up a lot is more of a challenging effort,” said Hanna Howard, portfolio manager at Gabelli Funds. “It’s possible that they’ll meet expectations, but it’s going to be a little bit more challenging to beat as they have.”

Competition in the streaming space comes from Walt Disney Co., which recently enacted its own password crackdown, Paramount Global and Warner Bros. Discovery Inc. Still, many see Netflix as the biggest winner in the sector.

Analysts led by Tim Nollen at Macquarie see upside ahead for Netflix revenue given its ad tier and paid sharing, and recently lifted their target price — implying the stock has another 12% to gain from current levels.

“While still early in its advertising journey, early signs indicate potential upside to out-year estimates,” Nollen wrote. “We believe the company remains the undisputed leader in streaming TV.”

Tech Chart of the Day

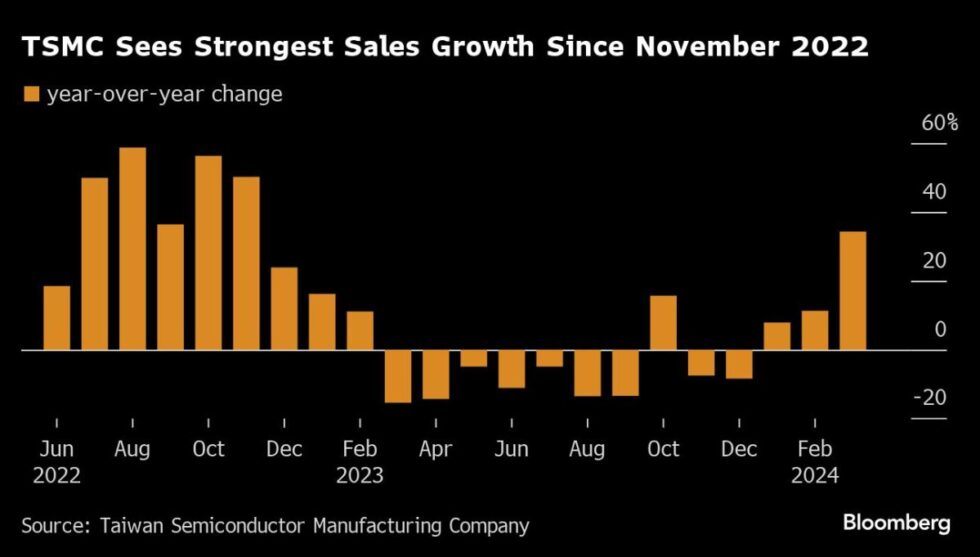

Taiwan Semiconductor Manufacturing Co. delivered a better-than-projected revenue outlook and stuck with plans to spend as much as $32 billion in 2024, shoring up expectations of sustained growth in AI demand. Its outlook may help assuage some investors worried that such demand won’t hold up, or that a smartphone recovery may be longer in coming.

Top Tech News

-

ASML’s weak order numbers in 1Q cooled down expectations for 2025, and now it needs “significant orders” over the next two quarters to hit the target for next year, Santander writes in a note that downgrades the stock to underperform from neutral.

-

TikTok is heading to its moment of truth in Washington, with Congress on a fast track to approve a bill aimed at forcing the social-media platform’s Chinese parent ByteDance Ltd. to divest its controversial ownership stake.

-

Deliveroo Plc said orders returned to growth with a 2% increase in the first quarter, driven by “strong progress” in the food-delivery company’s international segment.

-

Huawei Technologies Co. released its latest series of smartphones on Thursday, sustaining its momentum after the breakthrough Mate 60 device helped erode Apple Inc.’s dominance in China’s high-end segment.

-

Alphabet Inc.’s Google has fired 28 employees after they were involved in protests against Project Nimbus, a $1.2 billion joint contract with Amazon.com Inc. to provide the Israeli government with AI and cloud services.

Earnings Due Thursday

-

Badger Meter

-

Netflix

–With assistance from Gao Yuan, Jane Lanhee Lee, Mayumi Negishi and Stephen Kirkland.

(Updates stock moves)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email [email protected] Follow our WhatsApp verified Channel