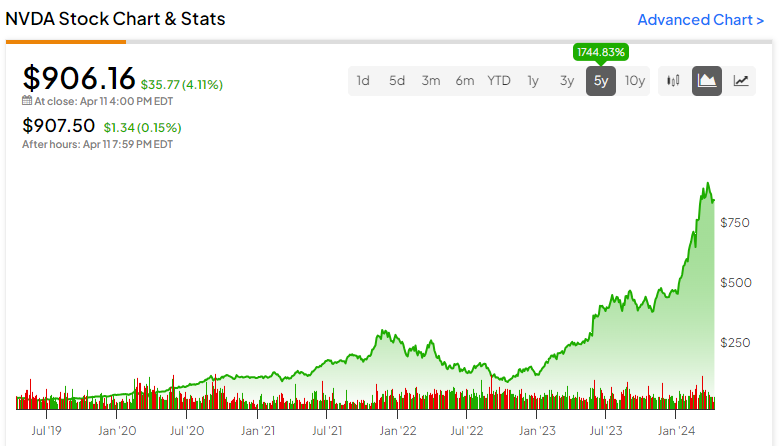

Nvidia (NASDAQ:NVDA) designs semiconductors used in everything from AI to gaming to crypto mining. The company also owns Cuda, an AI training software. I’m bearish on Nvidia, which trades at 76x earnings and what are likely peak profit margins. I believe the company is more cyclical than most people think.

Nvidia, like Tesla (NASDAQ:TSLA) in electric vehicles, has enjoyed a first-mover advantage in AI. The problem is that, like Tesla in electric vehicles, the competition has increased exponentially, and the company is cyclical and vulnerable to a recession.

A Terrific Company, But More Cyclical Than You Think

Nvidia is no doubt a revolutionary company. The AI language models that it helps power are changing the world. Search has become faster and easier than ever before, and AI will not stop there, with many more use cases on the horizon.

However, much of this revolution is now baked into Nvidia’s financials, with net income having increased from $4.37 billion in year-end 2023 to $29.76 billion in year-end 2024. This is an enormous increase.

Nvidia and the AI revolution look comparable to Intel (NASDAQ:INTC) in the Internet revolution of the late 1990s. I recently checked Intel’s financials from 1993-2000, the period marked by the inception of the Internet. Intel’s net income increased at a much slower pace than Nvidia’s.

It took seven years for Intel’s net income to increase 360% vs. one year for Nvidia’s net income to increase 581%. During the recession of 2001, as the Internet bubble deflated, Intel’s net income collapsed 88% from year-end 2000 to year-end 2001.

I suspect Nvidia’s profits will be no less cyclical than Intel’s. Yet, the market is pricing in an unending upward trend in the company’s earnings. The fact that Nvidia’s net income increased so fast means there’s less growth ahead, not more. If Nvidia’s customers suffer in a recession, which I believe they will, Nvidia will suffer too in terms of falling earnings.

In Nvidia’s annual report, the company outlined these risks, saying, “Because most of our sales are made on a purchase order basis, our customers can generally cancel, change or delay product purchase commitments with little notice to us and without penalty.”

Competition Is Coming

Nvidia’s operating margin is at a record high of 54%, but if we look at the company’s history, its average operating margin is closer to just 20%. In a cyclical industry like chip designing, this is a red flag. It means earnings could fall more than 50% just to get back to the norm. In recessions, things can get even worse. Nvidia’s operating margin approached the low single digits in the recession of 2003 and went negative in 2009.

There are two reasons Nvidia’s margins could contract. One is the economic weakness we discussed earlier, which could affect Nvidia’s customers. Two is increasing competition, which is now coming from everywhere, including Nvidia’s own customers.

This risk was outlined in Nvidia’s annual report, which stated, “Our partners or customers may develop their own solutions; our customers may purchase products from our competitors; and our partners may discontinue sales or lose market share in the markets for which they purchase our products.”

All the semiconductor investment we’re seeing, spurred by AI hype and governmental support, is bad news for Nvidia. Big tech companies are spending billions on in-house solutions, Advanced Micro Devices (NASDAQ:AMD) and Intel are racing to catch up, and China is attempting to become semiconductor self-reliant.

I hate industries that are seeing a lot of investment and increasing competition because that’s usually bad for future profit margins. Nvidia was developing AI solutions in a sleepy market for years, but that has all changed now. AI is the hottest market there is, and new competitors are spending R&D money hand over fist. For this reason, I cannot be sure who will have the technological edge in 10 years’ time. Just as Intel has, Nvidia could easily lose its edge over the years.

NVDA Stock’s Valuation Is Extreme

Despite having seen its net income and margins explode upwards, Nvidia is now trading at 76x earnings, 36x sales, and 51x book. Normally, you see the market pricing in that a company is nearing a cyclical peak when earnings surge 581% year-over-year by assigning lower multiples. However, this is certainly not the case for Nvidia.

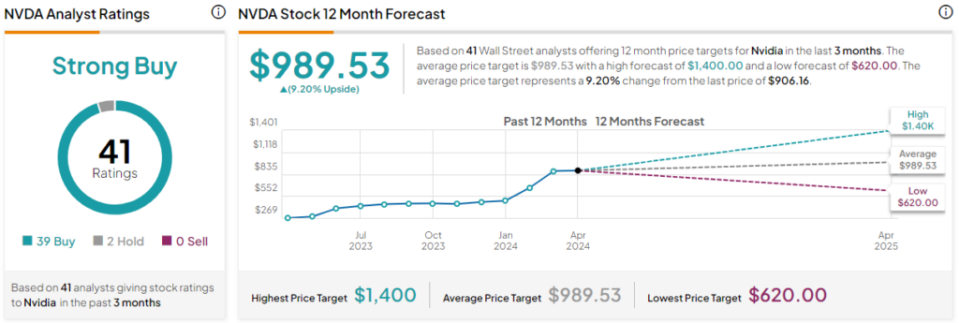

Is NVDA Stock a Buy, According to Analysts?

Currently, 39 out of 41 analysts covering NVDA give it a Buy rating, two rate it a Hold, and zero analysts rate it a Sell, resulting in a Strong Buy consensus rating. The average Nvidia stock price target is $989.53, implying upside potential of 9.2%. Analyst price targets range from a low of $620 per share to a high of $1,400 per share.

The Bottom Line on NVDA Stock

I believe Nvidia is comparable to Intel near the peak of the dot-com bubble. Intel benefited from the Internet boom, with a dominant position in semiconductors used in PCs and technologies used for Wi-Fi. However, as competition increased, overinvestment ran rampant, and demand fell, Intel’s stock and earnings collapsed alongside those of other dot-com names.

The same could happen to Nvidia as semiconductor investment has surged in big tech land and China. With a 581% year-over-year increase in earnings, Nvidia’s profits could be nearing a peak. The next recession may mark the end as orders for Nvidia’s products can quickly be canceled due to an industry-specific downturn, wide-scale recession, or substitution for another company’s products.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email [email protected] Follow our WhatsApp verified Channel