It wasn’t long ago that investors were wondering if a publicly traded U.S.-based company would ever reach the $1 trillion threshold. But in early August 2018, Apple hit that coveted mark. Not long after that, the market saw a correction. The market sold off heavily in late 2018 over tensions with the U.S.-China trade war and uncertain Federal Reserve policy. It eventually recovered, but then the COVID-19 sell-off of spring 2020 hit.

Another recovery took hold in short order and Apple regained trillion-dollar status, even rising above $2 trillion. By early January 2022, Apple was knocking on the door of a $3 trillion market cap, Microsoft was hovering around $2.5 trillion, Alphabet was almost at $2 trillion, Amazon and Tesla (NASDAQ: TSLA) were both over $1 trillion, and Meta Platforms (NASDAQ: META) was less than 10% away from hitting $1 trillion.

2022 turned out to be a brutal year for big tech. When the dust had settled, only Apple, Microsoft, and Alphabet were still above $1 trillion in market cap.

Cycles happen, especially with companies with many different business units and an international footprint. Instead of trying to time the market by guessing which companies could surpass the $1 trillion threshold, a better idea would be to find the companies that can not only reach $1 trillion by the end of 2024 but are likely to build upon that valuation in the future.

After Meta’s blowout earnings report this week, six companies are currently over $1 trillion in market cap — Microsoft, Apple, Amazon, Alphabet, Nvidia, and Meta.

Here’s why Tesla and Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) are two top stocks worth buying before returning to trillion-dollar valuations.

1. More drama with Tesla stock

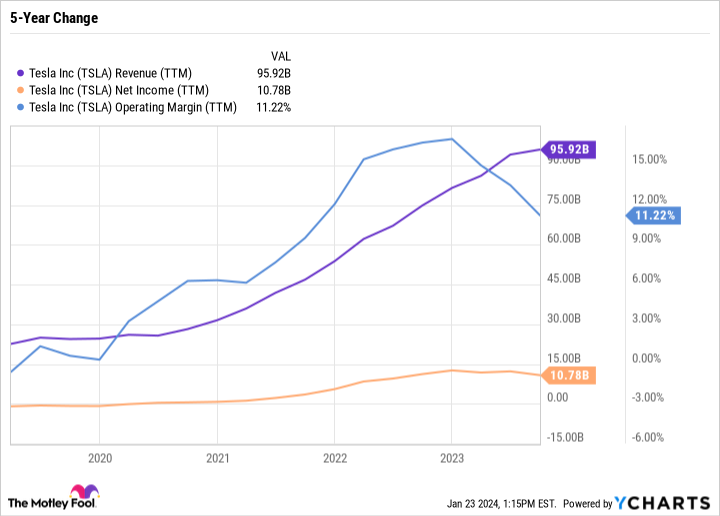

Tesla stock doubled in 2023 but it is still down nearly 50% from its all-time high. And for good reason. Despite hitting its 2023 production goal, Tesla’s growth has slowed — especially when you look at profits and revenue. Its margins are also down as Tesla had to cut prices to make up for weak demand.

If you look at trailing-12-month figures, sales are up just 11.5%, net income is down 8.5%, and the operating margin has fallen by over 25% to just 11.2%.

CEO Elon Musk hasn’t done the company any favors as of late either, saying he is “uncomfortable growing Tesla to be a leader in AI and robotics” unless he has more voting control of the company.

Tesla can be a roller coaster of a stock and will probably remain volatile not just because it is in a cyclical industry, but also because the top brass can pour a lot of emotion into the company. However, you can argue that this emotion has done more good than harm.

Tesla remains the undisputed leader in electric vehicles (EVs). And although competition is mounting, no company is close to holding a candle to Tesla when it comes to the balance between profitability, international exposure, growth potential, and the trajectory the company is on to release lower-priced EV models for customers.

Six years ago, Tesla was inconsistently profitable and hadn’t scaled production of the Model 3 to achieve consistent cash flows. At that stage, emotional comments carried more weight. But today, Tesla is much more secure. Elon Musk is the voice of Tesla, but he is far from calling all the shots or operating with unilateral control.

Tesla has the balance sheet and cash flows to endure a self-inflicted setback or an industrywide slowdown. There’s also a good chance that Tesla will take market share during a slowdown rather than lose it because other companies with legacy operations and budding EV segments may be more inclined to cut EV spending than damage an existing cash cow.

Overall, Tesla is a good balance of risk and reward if you can stomach the volatility.

2. Berkshire Hathaway contains multiple pockets of hidden value

Hovering around an all-time high and a market cap of just over $800 billion, Warren Buffett-led Berkshire Hathaway is the second-closest company to $1 trillion behind Meta. The company has a lot of ways it can get there. The value of its public equity portfolio alone is $368.8 billion — leaving the rest of the business to be valued at about $438.3 billion.

Berkshire owns dozens of companies outright and has stakes in several private businesses. The sheer size of the overall company can be difficult to wrap your head around. Berkshire could be undervalued based on the major contributors alone.

Berkshire’s insurance businesses alone hold a treasure trove of value thanks to their predictable earnings and stability. The property and casualty insurance businesses are split into the investing side and the underwriting side. Its underwriting operations include GEICO, Berkshire Hathaway Primary Group, and Berkshire Hathaway Reinsurance Group.

Berkshire is a master underwriter and has built a sizable float that grew to approximately $164 billion at the end of 2022. Valuing the insurance business alone by its float, which would be ultra-conservative, would make this asset worth around 20% of the overall market cap of the company.

There’s also Berkshire’s ownership of BNSF railroad, which booked nearly $6 billion in net earnings in 2022. Berkshire also owns a 92% stake in Berkshire Hathaway Energy, which could be worth around $90 billion. Finally, Berkshire generated $12.51 billion in net earnings from its manufacturing, service, and retailing businesses in 2022.

Putting just a 10 price-to-earnings multiple on BNSF railroad and the manufacturing, service, and retailing business would make those businesses worth over $180 billion combined.

Add it all up, and very conservative valuations make Berkshire worth what it is today. Reasonable valuations would easily push its worth up over $1 trillion. Berkshire can surpass and stay above $1 trillion for a variety of reasons, like growing its businesses over time or multiple expansions for what it already owns.

Quality businesses with plenty of room to run

Investing in a stock just because it is going up is a good way to lose money. To buy shares in a business, you need to be able to justify that it will be worth more in the future than it is today. Tesla is an industry leader with clear growth paths. Berkshire Hathaway is a conglomerate that blends value and growth from various sectors.

Both stocks have done well over the last year and could pull back if the market sells off. But if the market keeps rallying, I could see both companies worth over $1 trillion by the end of the year. In three to five years, it would be very surprising if any of these companies were worth less than $1 trillion.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now… and Tesla made the list — but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of January 22, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, Meta Platforms, Microsoft, and Tesla. The Motley Fool has a disclosure policy.

Prediction: These 2 Stocks Hit a $1 Trillion Market Cap By The End Of 2024? was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email [email protected] Follow our WhatsApp verified Channel