(Bloomberg) — European stocks and US futures gained as investors’ focus shifted from Middle East tensions to a raft of company earnings scheduled for this week, including reports by more than half of the “Magnificent Seven” cohort of tech megacaps.

Most Read from Bloomberg

The Stoxx Europe 600 index gained about 0.2%, recouping some of last week’s slide as traders took comfort from the absence of further escalation from Iran following Israel’s retaliatory strike. S&P 500 futures advanced by about 0.4% after the US gauge recorded its worst week since March 2023.

Demand for havens eased, after US Treasuries and the dollar were whipsawed last week by Middle East tensions as well as hawkish comments from Federal Reserve officials indicating reluctance to cut rates anytime soon. A Bloomberg dollar index was steady while the yield on 10-year US Treasury yields advanced two basis points. Oil and gold both fell.

“We are seeing a relief rally underway this morning as geopolitical risks subside,” said Kyle Rodda, a senior market analyst at Capital.com in Melbourne. “The move basically squares the ledger now and allows the markets to go back to focus on macroeconomic and corporate fundamentals.”

Among individual movers in Europe, Prosus NV shares jumped as much as 5% as Tencent Holdings Ltd., in which it is a major shareholder, rallied after nailing down an earlier-than-anticipated debut of one of the year’s most eagerly-awaited mobile games.

Galp Energia SGPS SA surged as much as 19% after the Portuguese oil company provided an update on a commercial oil find off the coast of Namibia. Sandoz Group AG climbed more than 4% to a record after the Swiss pharma company confirmed the European Commission’s approval of its Pyzchiva psoriasis drug.

In US pre-market trading, Tesla Inc. fell about 1.8% after announcing price cuts for its electric vehicles. Software maker Salesforce Inc. gained 3% after Bloomberg reported that takeover talks with Informatica Inc. have cooled.

Robust Earnings

Robust earnings from Corporate America will pull the S&P 500 Index out of its latest morass, despite rising concerns about a significant jump in bond yields, according to Bloomberg’s latest Markets Live Pulse survey.

With reporting season kicking into high gear this week featuring results from Big Tech giants such as Microsoft Corp., Meta Platforms Inc. and Alphabet Inc., nearly two-thirds of 409 respondents said they expect earnings to give the US equity benchmark a boost. That’s the highest vote of confidence for corporate profits since the poll began asking the question in October 2022.

Profits for the seven biggest growth companies in the S&P 500 — Apple, Microsoft, Alphabet, Amazon.com Inc., Nvidia Corp., Meta and Tesla — are on course to surge 38% in the first quarter, according to Bloomberg Intelligence. When excluding them, the rest of the benchmark index’s profits are anticipated to shrink by 3.9%.

Traders are also recalibrating their positions after a solid run of US data forced the Fed to reset the clock on its first interest rate cut. Data prints later in the week are likely to help finesse policy bets, with both US growth and the Fed’s preferred measure of inflation due.

A hefty slate of Treasuries auctions will be a major test of whether yields have peaked for the year.

Higher-than-expected interest rates amid persistent inflation are perceived as the biggest threat to financial stability among market participants and observers, the Fed said in its semiannual Financial Stability Report published Friday.

Key events this week:

-

Eurozone consumer confidence, Monday

-

Philippines and US military forces commence annual war games near Taiwan and South China Sea, Monday

-

ECB President Christine Lagarde speaks, Monday

-

Eurozone S&P Global Manufacturing PMI, S&P Global Services PMI, Tuesday

-

UK S&P Global, CIPS Manufacturing PMI, Tuesday

-

Australia CPI, Wednesday

-

Indonesia rate decision, Wednesday

-

IBM, Boeing, Meta Platforms earnings, Wednesday

-

Malaysia CPI, Thursday

-

South Korea GDP, Thursday

-

Turkey rate decision, Thursday

-

US GDP, wholesale inventories, initial jobless claims, Thursday

-

Microsoft, Alphabet, Airbus, Caterpillar earnings, Thursday

-

Japan rate decision, Tokyo CPI, inflation and GDP forecasts, Friday

-

US personal income and spending, University of Michigan consumer sentiment, Friday

-

Exxon Mobil, Chevron earnings, Friday

Some of the main moves in markets:

Stocks

-

The Stoxx Europe 600 rose 0.2% as of 9:40 a.m. London time

-

S&P 500 futures rose 0.4%

-

Nasdaq 100 futures rose 0.5%

-

Futures on the Dow Jones Industrial Average rose 0.4%

-

The MSCI Asia Pacific Index rose 1%

-

The MSCI Emerging Markets Index rose 0.6%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0655

-

The Japanese yen was little changed at 154.69 per dollar

-

The offshore yuan was little changed at 7.2522 per dollar

-

The British pound was little changed at $1.2366

Cryptocurrencies

-

Bitcoin rose 2.3% to $66,121.48

-

Ether rose 2.1% to $3,215.58

Bonds

-

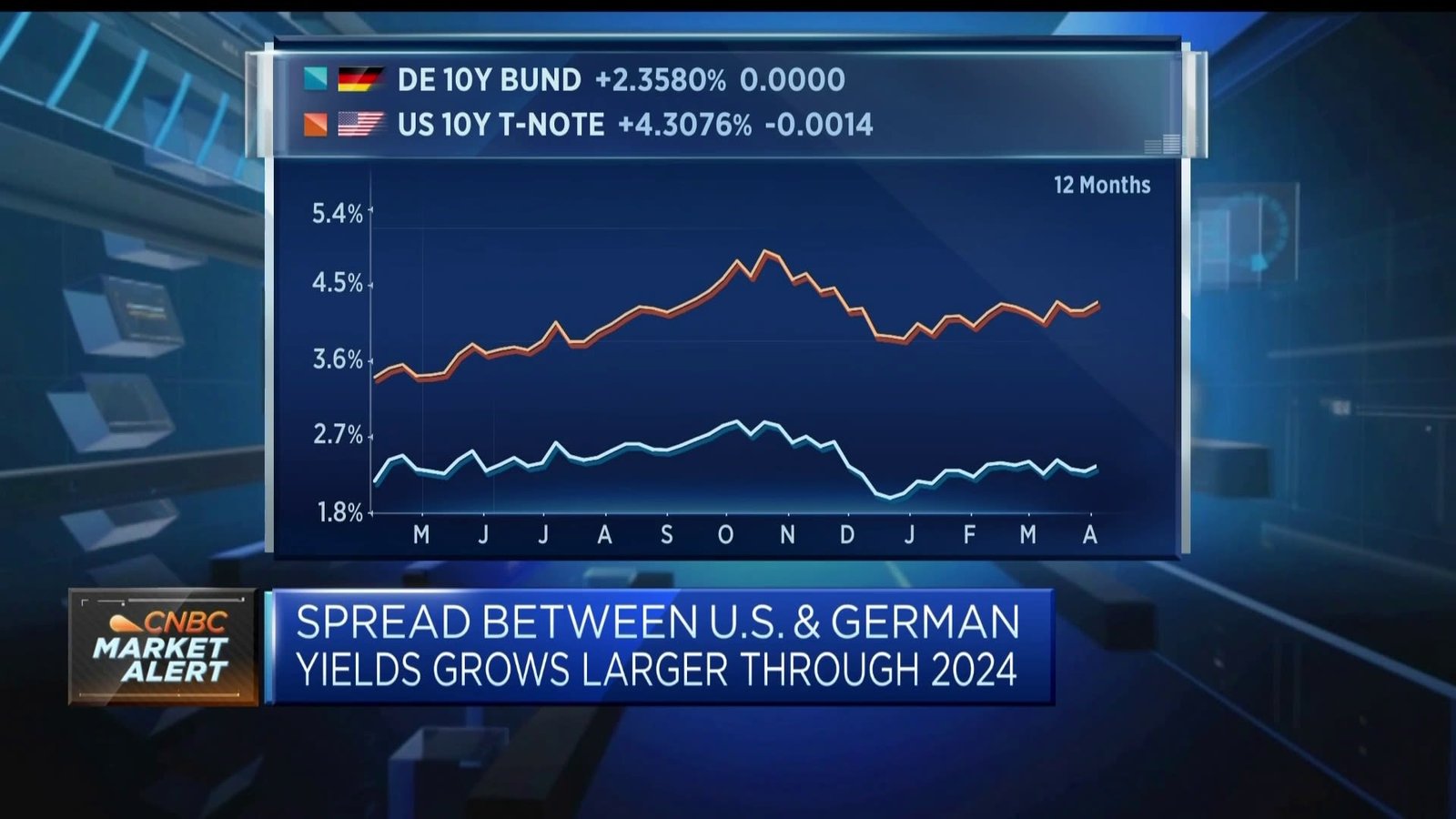

The yield on 10-year Treasuries advanced two basis points to 4.64%

-

Germany’s 10-year yield advanced two basis points to 2.52%

-

Britain’s 10-year yield was little changed at 4.23%

Commodities

-

Brent crude fell 1.5% to $85.98 a barrel

-

Spot gold fell 1.3% to $2,360.96 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Winnie Hsu, Divya Patil, Catherine Bosley and Michael Msika.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email [email protected] Follow our WhatsApp verified Channel