Bill Gates is the sixth richest person in the world, according to The Real-Time Billionaires List from Forbes. He made his fortune by co-founding tech giant Microsoft (NASDAQ: MSFT). However, he began transitioning away from the company in 2008 to focus his attention full-time on his charitable organization, the Bill & Melinda Gates Foundation.

The foundation has a portfolio of stocks — worth roughly $39 billion as of this writing — to help fund its efforts. For investors, it may seem like a good idea to dissect this portfolio as a source of investing insight.

However, investing is a personal journey. And while one can learn from other investors, it’s important to understand how personal situations can differ. Only once the differences are appreciated can one draw insight from the foundation’s portfolio.

Dissecting the $39 billion portfolio

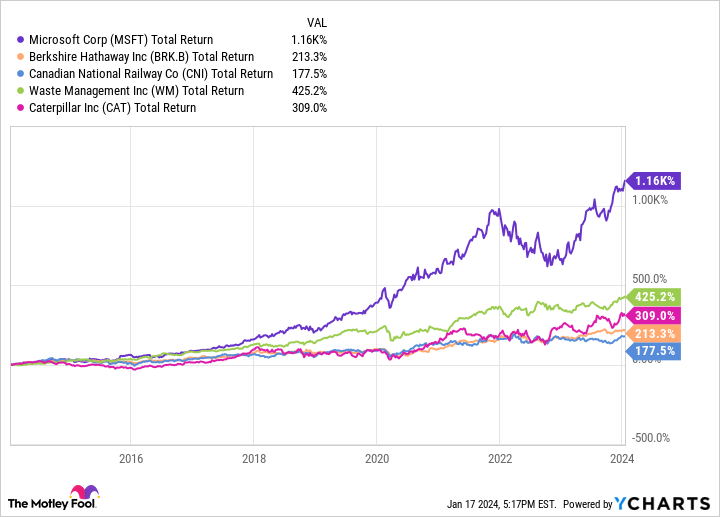

Most of the Bill & Melinda Gates Foundation portfolio is invested in just five stocks: Microsoft, Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B), Canadian National Railway Company (NYSE: CNI), Waste Management (NYSE: WM), and Caterpillar (NYSE: CAT).

These five positions make up 86% of the foundation’s holdings, a top-heavy concentration one doesn’t typically see in a well-diversified portfolio. In fact, it’s even more concentrated than it first looks: Microsoft and Berkshire Hathaway stock comprise 52% of the total value.

Four of these five stocks also pay a dividend with Berkshire Hathaway being the only exception.

Therefore, investors looking for inspiration might conclude they should build a similarly concentrated portfolio of dividend-paying stocks if they want to succeed in the market. But that’s the wrong takeaway here.

Why this isn’t a good model for most investors

In the first place, these stocks don’t all represent investment choices made by the portfolio managers for the Bill & Melinda Gates Foundation. Bill Gates donated Microsoft stock, and his close friend Warren Buffett donated Berkshire Hathaway stock. That’s why these two stocks make up so much of the holdings.

For most investors, it’s far better to diversify a portfolio into at least 25 stocks. Such diversification protects investors from excessive downside risk in any one stock.

But on the flip side, the portfolio for the Bill & Melinda Gates Foundation isn’t a good model for most investors because it might be excessively conservative.

Most of these five stocks are dependable blue chip companies. There’s nothing wrong with that, but for investors with a long time horizon, it’s good to also allocate a major portion of a portfolio toward higher growth opportunities.

A better takeaway

For a non-profit organization such as the Bill & Melinda Gates Foundation, preserving capital is crucial. When looking at 10-year returns for these five stocks, their shares have rarely dipped into the negative at any point. They’ve pulled back from their highs, but they’ve rarely ever dipped enough for the investment to be in the negative.

This is true of many of the blue chip dividend stocks. Not all outperform the S&P 500, but few dip into negative territory.

This is important when thinking about portfolio construction. Investors might want to invest 1% or 2% in an opportunity with high upside potential but elevated downside risk. In contrast, anchoring a portfolio to a consistent dividend payer could provide a good foundation for the overall portfolio.

Waste Management is a good example of a stock that can be foundational to a portfolio. The company takes care of trash around the U.S., and it has a real competitive advantage. For example, as of the end of 2022, it owned or operated 259 landfills. When thinking about local permitting for landfills and their proximity to where trash is collected, it’s hard for any competitor to come in and duplicate Waste Management’s business.

The Bill & Melinda Gates Foundation’s situation is a good reminder of how important a solid company like Waste Management is to a portfolio. Investors looking for growth wouldn’t want to concentrate too much of their holdings in this kind of company, but reliable blue chips certainly have a place considering their record of positive long-term returns.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now… and Microsoft made the list — but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of January 8, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway and Microsoft. The Motley Fool recommends Canadian National Railway and Waste Management. The Motley Fool has a disclosure policy.

The Bill & Melinda Gates Foundation Has 86% of Its $39 Billion Portfolio Invested in Just 5 Stocks was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email [email protected] Follow our WhatsApp verified Channel