Selling an assortment of products that appeal to teens and preteens, Five Below (NASDAQ: FIVE) is a retail concept that’s gaining ground across the country. But you wouldn’t know that from investors’ reaction after the company reported full-year financial results for 2023. After the report dropped, Five Below stock itself dropped by 15%.

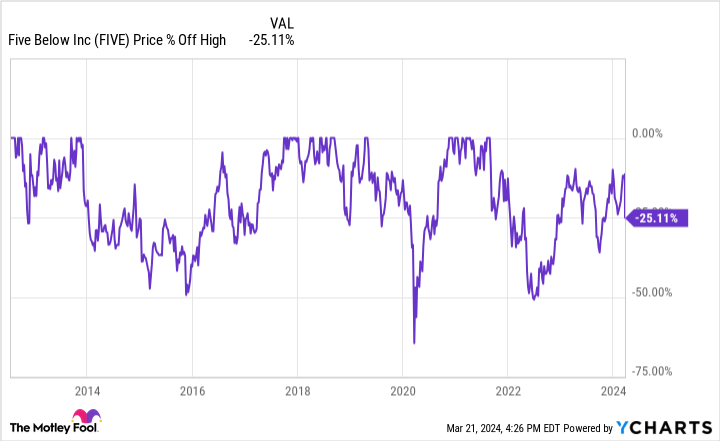

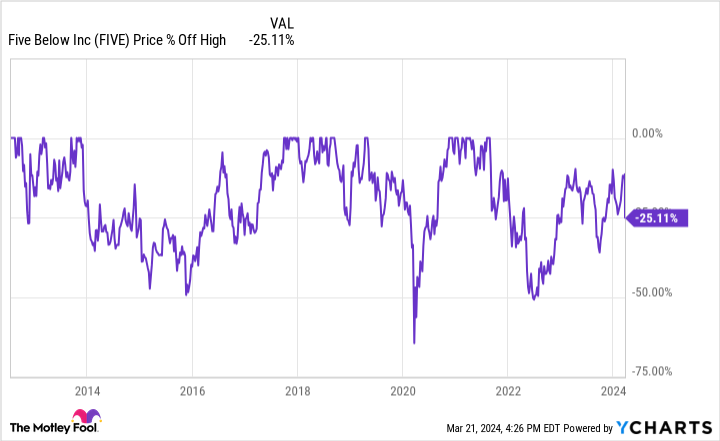

Five Below shareholders are used to pullbacks. Since the company went public in 2012, it’s fallen 15% or more quite a few times, as the chart below shows. For patient investors with a long-term focus, these pullbacks are great opportunities. Five Below is fast-growing, profitable, and has large aspirations that can turn this into a solid contributor to any stock portfolio.

Why I love Five Below stock

The Five Below investment thesis is devilishly simple. The company intends to open about 2,000 new retail locations by 2030. These locations pay for themselves in about one year. This means the company’s cash flow quickly soars without the company taking on risky financing. As Five Below’s cash flow soars, so too should its stock price.

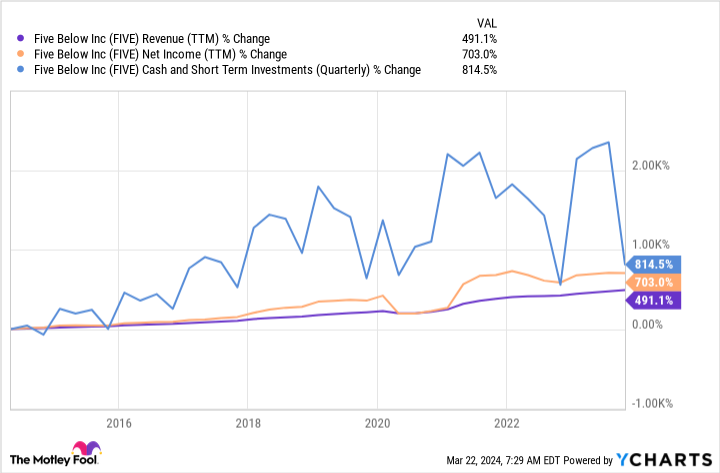

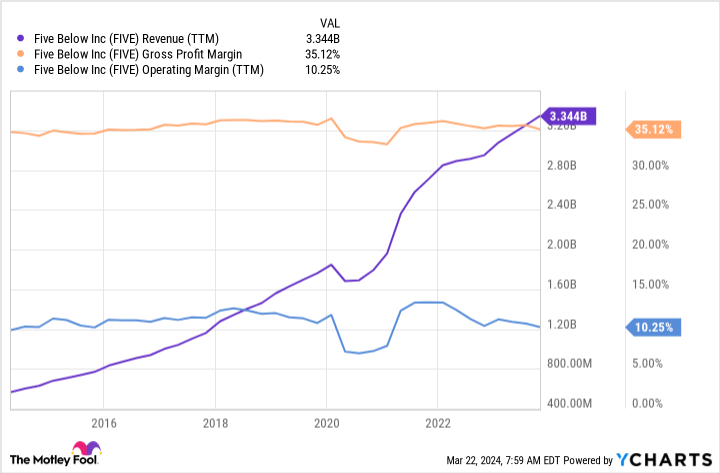

Let’s see how this has played out for Five Below during the past 10 years. At the end of its fiscal 2013, Five Below had 304 locations. At the end of fiscal 2023, the company had 1,544 locations — an increase of 1,240 locations. These new locations have dramatically increased overall sales. And same-store sales increased in eight of the last 10 years, contributing to higher overall sales as well.

Five Below’s numbers paint a picture of how good these new locations have been for the overall business. At the end of 2013, the company had just $50 million in cash and $20 million in debt. And its net income for the year was $32 million. By comparison, Five Below generated net income of over $200 million in its fiscal 2023, finishing the year with $460 million in cash, cash equivalents, and short-term investments as well as zero debt.

Why I still love Five Below for 2024 and beyond

In short, Five Below has continued doing what it needs to do to be a good investment: opening new stores. It has launched over 1,000 profitable locations, which have quickly paid for themselves, keeping the company out of debt and with a growing pile of cash. In 2023, Five Below opened over 200 new locations. Same-store sales were up almost 3%. And it had net income of almost $100 million.

Perhaps some investors are concerned about the long term because of inflation. After all, Five Below’s name implies that its merchandise costs less than $5. In an inflationary time, that gets harder to do while still maintaining profitability.

However, Five Below has demonstrated that it’s not stuck because of its name. The company is now filling a large part of its stores with a section it calls “Five Beyond.” In short, Five Beyond gives it the ability to sell merchandise at any price and its customers don’t seem to care.

I believe this is part of the reason that Five Below is so consistent with its profits. Over the last 10 years, its gross margin has remained in the mid-30% range. And its operating margin has generally been above 10%. Therefore, I’m not worried about Five Below’s profit margins because it’s not trapped selling things at under $5.

Now here’s the exciting part: By 2030, Five Below wants to have more than 3,500 locations — that’s almost 2,000 more stores than it has today. Assuming all the trends with its business model hold up, this company will be a cash-flow machine by then with no debt obligations.

From there, Five Below could return quite a bit of cash to shareholders since it wouldn’t have pressing financial needs. Perhaps it could pay a dividend or perhaps it could repurchase a lot of shares. But either way, it looks good for investors.

Trading at just 3 times its trailing sales, Five Below is also a reasonably priced stock. So for investors who like growth at a reasonable price, this is a stock to buy and hold for the long term.

Should you invest $1,000 in Five Below right now?

Before you buy stock in Five Below, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Five Below wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 21, 2024

Jon Quast has positions in Five Below. The Motley Fool recommends Five Below. The Motley Fool has a disclosure policy.

This Stock Dropped After Earnings. But It’s Now a Top Growth Stock to Buy in 2024. was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email [email protected] Follow our WhatsApp verified Channel