Getting added to the S&P 500 Index (SPX) is a big deal for any equity. Fund managers who track the S&P 500 will have to buy the stock to stay on target. All of those buy orders can raise the stock price higher and bring more attention to the equity. Buying a stock before it joins the S&P 500 can set an investor up for a nice payday. Some companies that fit this category have great potential to outperform the market, and some already have a history of exceeding market returns.

The S&P 500 Index isn’t open to every company. The index has several standards for inclusion, but these are the core requirements:

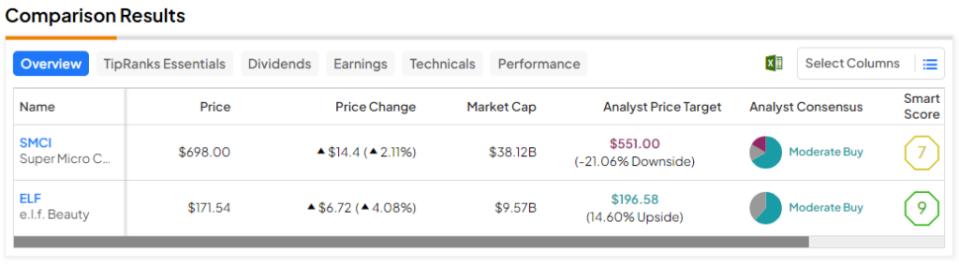

Investors can narrow their search with these parameters to find the next stocks that may join the S&P 500. I have identified Super Micro Computer (NASDAQ:SMCI) and e.l.f. Beauty (NYSE:ELF) as two promising stocks that can be added to the S&P 500 this year. I’m bullish on both of them.

The Bull Case for Super Micro Computer

Super Micro’s inclusion in the S&P 500 Index feels inevitable. The corporation has capitalized on artificial intelligence demand by offering servers that can handle the intense workloads of AI chips and tools. The stock has trounced the market with a 145% year-to-date gain, a 675% gain over the past year, and a 4,324% gain over the past five years.

Super Micro reported $640 million in net income in Fiscal 2023 and continues to deliver profitable quarters. Supermicro also fulfills the market cap requirement with a healthy margin of safety. The stock currently trades at a $39 billion market cap.

Super Micro’s latest earnings report and guidance suggest there’s more room for the stock to run. For instance, revenue growth came in at 103% year-over-year in the second quarter of Fiscal 2024, and the midpoint of SMCI’s raised guidance ($3.7-4.1 billion in sales expected in Fiscal Q3) suggests revenue will more than triple year-over-year in Q3.

The firm’s continued growth will beget more growth once it gets added to the S&P 500 Index since it’s a weighted index. This type of index prioritizes equities based on their market caps. In other words, as SMCI’s market cap grows, fund managers will have to purchase more shares to stay in line with the S&P 500.

These purchases will feed into the stock’s market cap and can create a positive loop. That’s why all of the largest positions in the S&P 500 are trillion-dollar companies.

Is SMCI Stock a Buy, According to Analysts?

Based on four Buys, one Hold, and one Sell assigned in the past three months, SMCI stock comes in as a Moderate Buy. Currently, analysts suggest that SMCI stock has 19.4% downside potential, but investors must take this conclusion with a grain of salt. One of the price targets is from December 2023, which lowers the stock’s average price target considerably.

The Bull Case for e.l.f. Beauty

e.l.f. Beauty is the second stock that is likely to join the S&P 500 soon. The company’s entry may be delayed until next year since its market cap is roughly $9.5 billion. That’s just short of the $12.7 billion market cap requirement, but strengthening financials suggests this barrier won’t be a problem for the company.

e.l.f. Beauty only uses ethical ingredients in its beauty products and continues to gain market share in the industry. This approach has worked well for the business based on its 20 consecutive quarters of net sales growth.

e.l.f. Beauty closed out the third quarter of Fiscal 2024 with 85% year-over-year revenue growth and 40.8% year-over-year net income growth. Revenue growth is accelerating when compared to the company’s 80% revenue growth rate for the nine months ended December 31, 2023.

e.l.f. Beauty raised its Fiscal 2024 outlook in a big way. The company’s revenue and net income midpoints received increases of 9.3% and 13.8%, respectively.

While e.l.f. Beauty isn’t eligible for S&P 500 inclusion quite yet, it has soundly outperformed the market. The stock is up by 14% year-to-date, 131% over the past year, and 1,664% over the past five years.

Is ELF Stock a Buy, According to Analysts?

On TipRanks, ELF stock comes in as a Moderate Buy based on eight Buys, five Holds, and no Sell ratings assigned in the past three months. The average ELF stock price target of $196.58 implies 14.6% upside potential.

The Bottom Line on Supermicro and e.l.f. Beauty Stock

Super Micro Computer and e.l.f. Beauty are both stocks to watch that can get added to the S&P 500. SMCI is already eligible and seems like an easy choice due to its tailwinds and growth opportunities. e.l.f. Beauty is on the cusp of eligibility but is growing fast. It can take longer for the beauty company to earn its spot on the famed index.

Super Micro and e.l.f. Beauty have both outperformed the stock market over the past year and over the past five years. These equities can generate positive returns while investors wait for them to potentially get added to the S&P 500.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email [email protected] Follow our WhatsApp verified Channel