Warren Buffett purchased textiles company Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) in 1965, and he converted it into a holding vehicle for various investments. Today, it owns several private companies and 47 publicly traded securities.

Berkshire stock has delivered a compound annual return of 19.8% since Buffett took the helm in 1965, which is twice the return of the S&P 500 index. He follows a simple investing strategy which involves buying profitable businesses with steady growth and strong management teams. He especially likes companies returning money to shareholders through dividends and stock buybacks, which helps Berkshire compound its money more quickly.

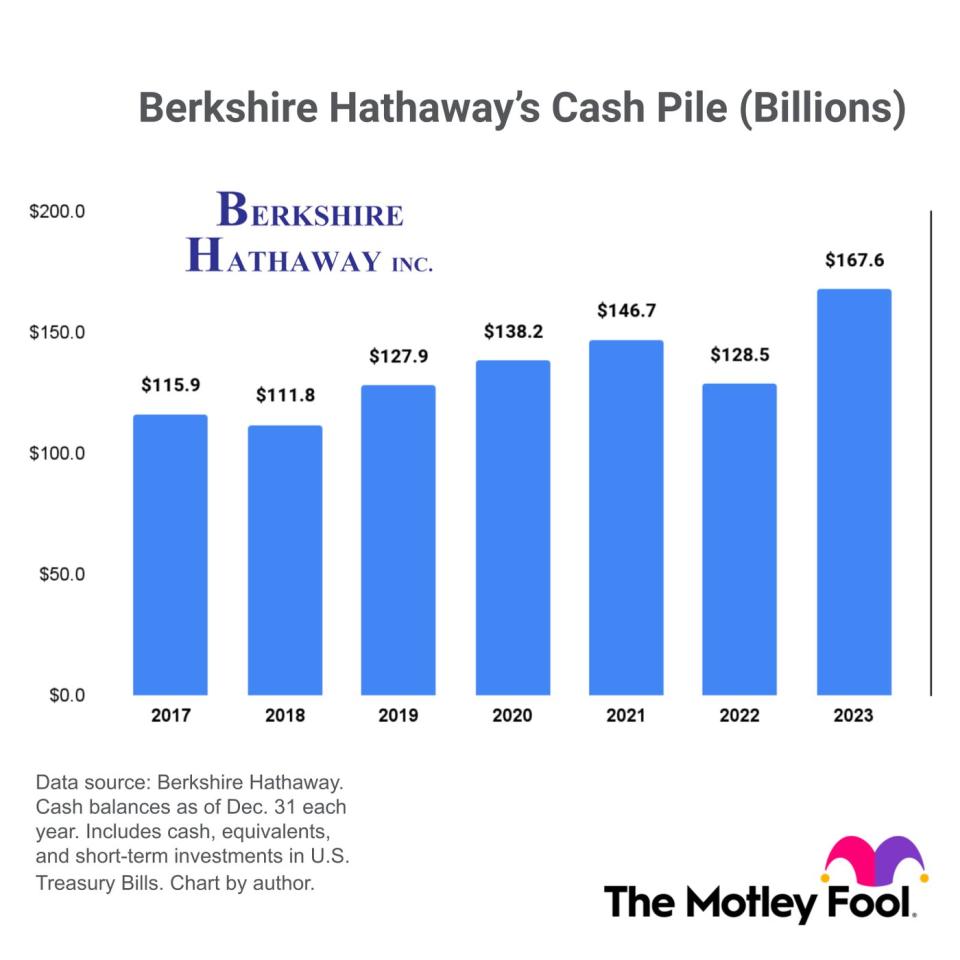

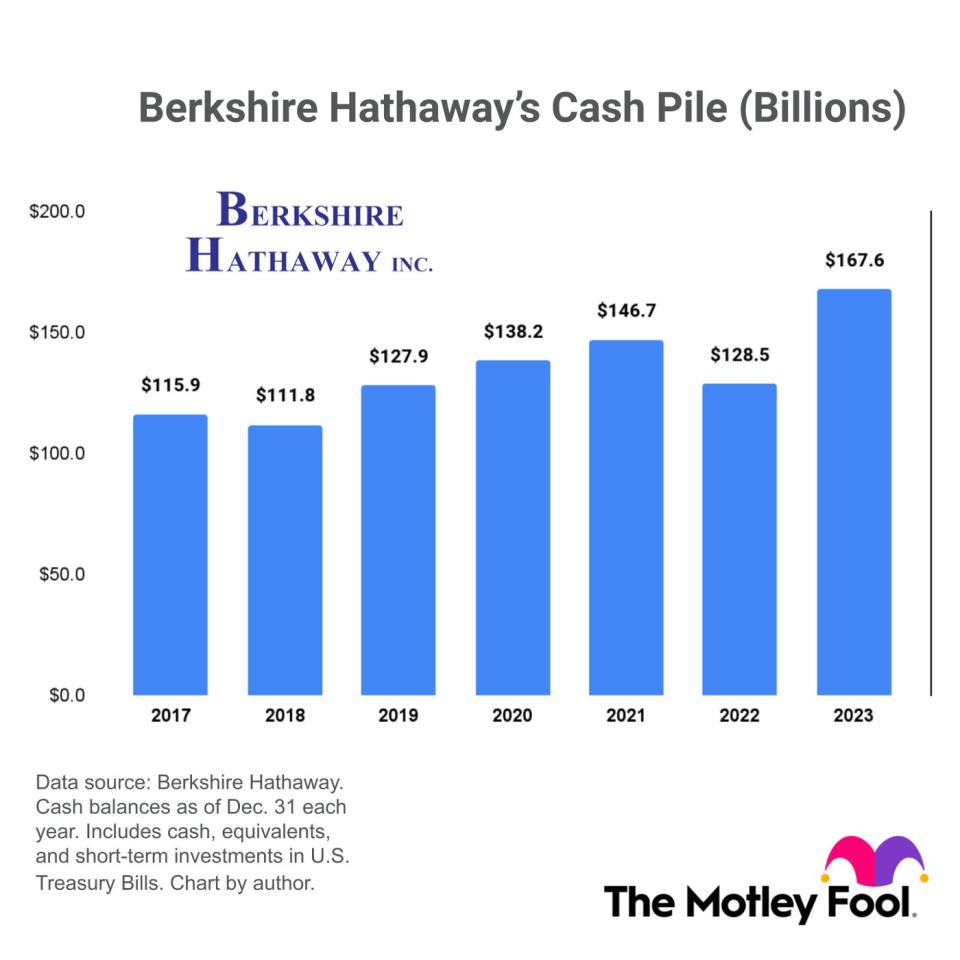

Berkshire has built a fortress balance sheet over the past 58 years with a record $167.6 billion in cash, equivalents, and short-term investments on hand at the end of 2023:

A list of companies Berkshire could (theoretically) buy outright

To put Berkshire’s cash pile into perspective, here are 10 globally recognized companies currently worth less than $167.9 billion:

-

General Electric: $166.8 billion

-

Uber: $162.4 billion

-

Nike: $160.1 billion

-

Morgan Stanley: $142.1 billion

-

United Parcel Service: $126.7 billion

-

Boeing: $122.5 billion

-

Blackrock: $120.8 billion

-

AT&T: $120.1 billion

-

Sony: $108.9 billion

-

Airbnb: $97.3 billion

To be clear, neither Buffett nor Berkshire have expressed interest in buying any of those companies. However, the fact the conglomerate can afford to do so is a testament to its incredible success.

Berkshire’s current top-three holdings include Apple, Bank of America, and American Express. Together, they account for 62.7% of the total value of Berkshire’s portfolio of publicly traded stocks. They are a good place to start for investors seeking to mimic Buffett’s returns.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 26, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. American Express is an advertising partner of The Ascent, a Motley Fool company. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Airbnb, Apple, Bank of America, Berkshire Hathaway, Nike, and Uber Technologies. The Motley Fool recommends United Parcel Service and recommends the following options: long January 2025 $47.50 calls on Nike. The Motley Fool has a disclosure policy.

Warren Buffett Is Sitting on a Record $167.6 Billion Cash Pile. Here are 10 Stocks Berkshire Hathaway Could Buy Outright. was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email [email protected] Follow our WhatsApp verified Channel